KSM permit milestone builds ‘competitive tension’ for huge gold-copper project, Seabridge’s Fronk says

Seabridge Gold (TSX: SEA; NYSE: SAKSM) has long been seen as a juicy takeover candidate for its huge KSM gold-copper deposit, but its remote, mountainous location in British Columbia, US$6.4-billion price tag, and uncertain permitting path have been obstacles to clinching a deal.

Now that one of those factors has changed—permitting—chairman and CEO Rudi Fronk says the company could be in a position to sign on a well-heeled joint venture partner within months to help it develop the mammoth project. He says he was close to signing a deal in 2020 when COVID-19 scuppered talks.

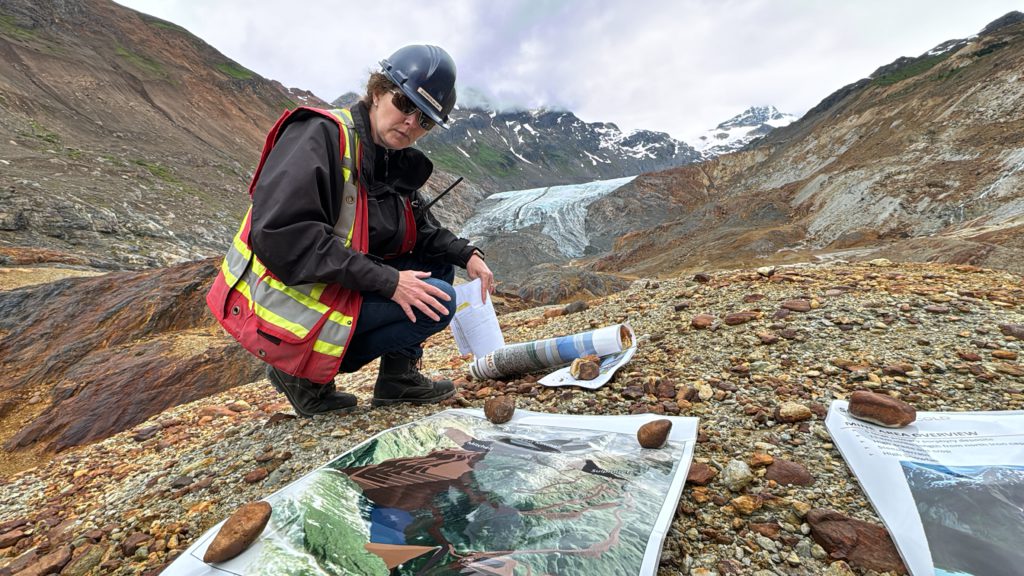

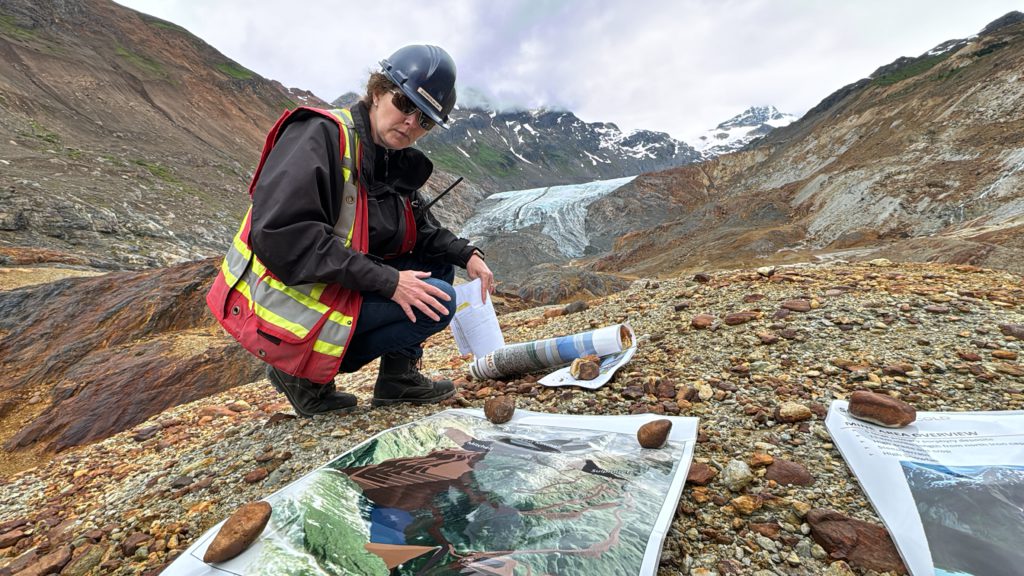

“With six major gold and copper companies currently at the table, we are confident that we will secure a partnership that aligns with our vision and financial strategy,” he told The Northern Miner during a site visit to KSM in late July. "The nice thing right now is for the first time ever, we have competitive tension going on in our process.”

RBC Capital Markets is managing a JV negotiation process, Fronk said. RBC has been brought in to manage and enhance the negotiation process for securing a JV partner, creating a competitive environment to secure the best possible deal for Seabridge.

A day before the permit milestone—a designation by the B.C. government acknowledging that construction at KSM has ‘substantially started’—Fronk predicted a deal could materialize quickly.

Comments