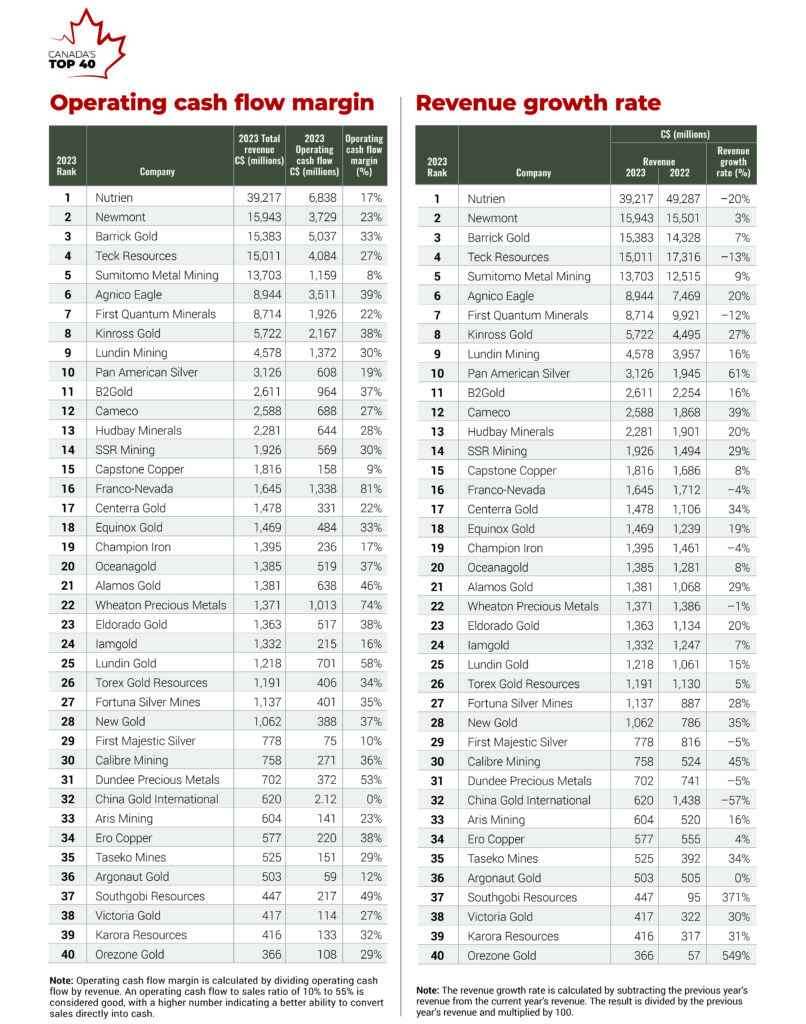

Ranking Canada’s Top 40: Top 40 companies bagged $166 billion in 2023

Nutrien continues clinching top spot despite revenue decline compared to last year,

and Oceanagold joins the list for the first time

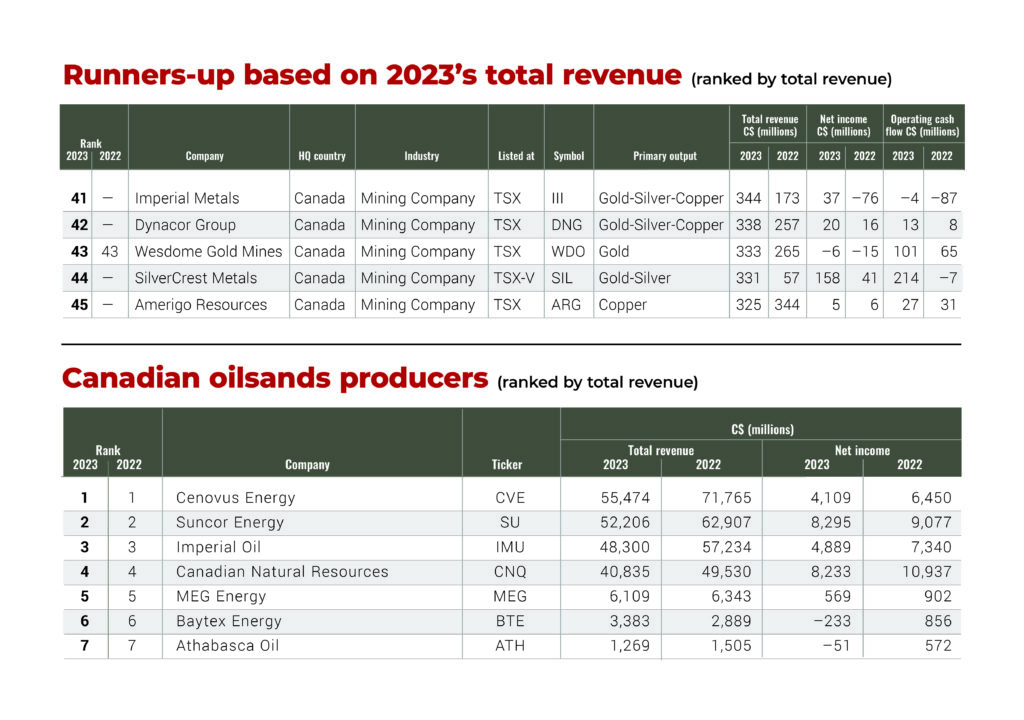

This year, potash continued to hold the top spot of the ranking. As expected, Nutrien’s stronghold on top of the ranking was not affected by Newmont’s acquisition of Newcrest. It is no surprise that, after Nutrien, the Top 40 are dominated by gold and copper miners.

Gold producers take over the next two spots: It has become quite common to our ranking to see Newmont, followed by Barrick, with the two reporting nearly identical total revenues close to $16 billion (see the main table for a full representation of the Top 40 revenue numbers).

Nutrien was formed in January 2018 as a result of a $36-billion

merger between Agrium and Potash Corp. of Saskatchewan.

However, of this year’s list, only 15 companies are primary gold miners. Thirteen companies on the list are gold-silver miners (one of which, Orezone Gold, made the list for the first time). The list had only two primary copper miners (Ero Copper and Taseko Mines), one primary silver producer (First Majestic Silver), two gold-silver-copper producers (Hudbay Minerals and Aris Mining which was new to the ranking last year and solidified its spot this year by moving from 34 to 33), and finally one copper-silver producer (First Quantum Minerals).

Gold domination of the ranking comes as no surprise, as the precious metal continued to be a winner overall last year. According to the World Gold Council, gold price ended 2023 at US$2,078.4 per oz. (a record high year-end close). Additionally, the record average 2023 gold price of US$1,940.54 per oz. was 8% higher than 2022 despite the demand dipping 5% from 2022.

The decline in the number of copper producers on the list is mainly because of the volatile copper prices in 2023, which were affected by factors such as the global economic conditions (rising interest rates), demand and supply (China’s real estate crisis hit copper demand hard in 2023), and the continued geopolitical events. While copper spiked to just above US$3.9 per lb early in 2023, it sunk to US$3.50 by the end of the year. The price stood an average of US$3.9 per lb in 2023, and the current copper price at the time of drafting this article is US$4.08 per lb, boding well for copper miners in next year’s Top 40.

Silver producers still have notable presence on the list despite the price of silver down by 3.27% in 2023 compared to the previous year.

Only three companies on the ranking had diversified portfolios: Teck, Sumitomo, and Lundin Mining. Sumitomo was the biggest addition to last year’s ranking, and it did not disappoint this year as it held to the fifth spot.

It is worth noting that, like last year, the list had two royalty and streaming companies (Franco-Nevada in 16 and Wheaton Precious Metals in 22; both almost unchanged from last year). The list also had the usual iron ore producer, Champion Iron in 19, slightly down from 18 in 2022. And the only uranium miner on the list is Cameco in 12, up from 14 last year with a considerable revenue increase, as uranium prices almost doubled in 2023 compared to 2022 driven by growing global demand for nuclear power to help achieve global net-zero greenhouse gas (GHG) emissions by 2050.

The biggest drop in this year’s list was China Gold International from 19 last year to 32 in this year’s list, probably affected by geopolitical events and China’s real estate crisis in 2023.

Newcrest and Copper Mountain, where art thou?

This year’s notable departures include Newcrest and Copper Mountain. Newmont acquired Australian miner Newcrest in a US$15-billion deal that added five active mines and two advanced projects to Newmont’s portfolio. The enlarged Newmont will have gold assets in North and South America, Africa, Australia, and Papua New Guinea. It will also expand its exposure to copper. This certainly helped bump Newmont to the second place this year from third in last year’s ranking, and it will continue to boost Newmont’s ranking next year, but we do not expect it to beat Nutrien to the top spot.

Copper Mountain disappeared from the ranking this year after an acquisition by Hudbay whose all-stock deal offered a 23% premium to Copper Mountain’s 10-day weighted average trading price at the time of announcement and valued the company at US$439 million.

Newmont made the list for the first time in 2020, following its US$10-billion acquisition

of Goldcorp.

New to the list: Oceanagold moves its headquarters to Canada: “Blimey!”

Oceanagold is a growing intermediate gold miner. The company has a portfolio of four operating mines: The Haile gold mine in the U.S., Didipio mine in the Philippines, and the Macraes and Waihi operations in New Zealand.

Late in 2022, the company’s president and CEO, Gerard Bond, announced the relocation of the company’s headquarters to Vancouver, B.C. Bond said in a statement, “Having regard to the location of our shareholder base, our operations, and opportunities, I will be relocating to Vancouver, Canada in the coming months and in due course this is where our corporate headquarters will be going forward.” With the company’s stock listed in TSX, Oceanagold met two of the Top 40 criteria and made the list for the first time in a whopping 20th spot.

Other additions to the list are the coal miner, Southgobi Resources, in 37, and Orezone Gold barely met the cutoff in 40.

For a few million dollars more!

When comparing year-on-year changes in revenue, the standout is Orezone Gold with revenues increasing dramatically to $366 million from $57 million in 2022. Its flagship Bomboré gold mine in Burkina Faso achieved commercial production on its oxide operations in December 2022 and is now focused on its staged hard rock expansion that led to materially increasing annual gold production from the processing of hard rock mineral reserves, leading to this upswing in revenues.

Pan American Silver is another major revenue mover, with revenues increasing to $3.1 billion, up from $1.9 billion in the prior year. This company’s 2023 financials were largely propelled by a merger and acquisition (M&A) deal, with the closing of a US$4.8-billion-joint-acquisition of Yamana with Agnico. A deal that added Yamana’s South American assets, four mines, to Pan American Silver’s profile.

According to a GlobalData report, in 2023, the global mining market witnessed deals worth US$121 billion, growth of 75% compared to 2022. In terms of deal volume, there was a growth of 5% to the M&A deals in 2023. The sector recorded 16 mega-deals (defined as any deal valued at more than US$1 billion), an increase of 33% compared to 2022.

Consequently, this year’s numbers are affected by some of these M&A deals of the past year.

Other major deals that affected the new ranking

According to a recent report by Costmine Intelligence, there were 125 closed mining M&A deals in 2023 valued at approximately US$35 billion. In addition to the Newmont/Newcrest deal, other top deals in 2023 that may have affected our ranking were the following:

> The Agnico and Pan American Silver US$4.8-billion-joint-acquisition of Yamana mentioned above also helped Agnico walk away with Yamana’s Canadian assets, the Malarctic Mine, Canada’s largest open pit gold mine.

> B2Gold acquired all the issued and outstanding common shares of Sabina Gold & Silver for US$823.66 million. Sabina wholly owned the Back River Gold project in Nunavut, as well as the fully permitted Goose gold project.

> Agnico acquired a 50% interest in the San Nicolas mine, a Teck Resources asset. The mine is a copper-zinc development project located in Zacatecas, Mexico. As a result of the transaction, Teck and Agnico Eagle will become 50/50 joint venture partners at San Nicolas.

> Most recently, Teck Resources announced it has completed the sale of its remaining 77% interest in its steel-making coal business to the Swiss commodities giant, Glencore. Prior to that, the federal government had announced its approval of the sale of the operation to Glencore.

Teck received US$7.3 billion from Glencore for its coal business, which it had to offload as part of the strategy to focus more on critical minerals and the energy transition. “This transaction marks a new era for Teck as a company focused entirely on providing metals that are essential to global development and the energy transition,” said Teck’s president and CEO Jonathan Price in a statement a few weeks ago.

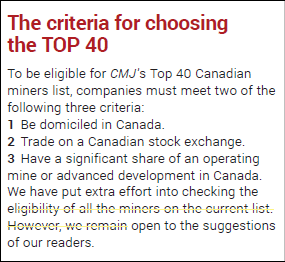

The runners-up

A list of five runners-up, including only Wesdome Gold from last year’s runners-up is also provided. The runners-up companies that meet the criteria for the Top 40 but just miss the revenue mark, all reported headline revenues for 2022 within $40 million of the cutoff mark for the Top 40. Four new companies made it to this year’s runners-up list: two gold-silver-copper miners (Imperial Metals and Dynacor), with the other two producing gold-silver (SilverCrest) and copper (Amerigo Resources).

Notably, Imperial Metals is back to our runners-up list. The company left the Top 40 ranking in 2020 when the miner sold a 70% stake in its Red Chris open pit to Australia’s Newcrest for US$807 million.

Oilsands

Finally, oilsands producers are in a separate table outside of the main ranking. There was no change at all in the ranking over the prior year, with all companies, except for Baytex, reporting major declines in revenue compared to 2022.

The forecast for 2024 ranking

The 2023 ranking proves that our forecast in last year’s article was successful. In 2024, we will continue to see a trend of mergers and acquisitions as the year unfolds and the gold rally continues to stimulate this trend among intermediate and junior miners.

Regarding lithium and other critical minerals’ producers, note that we do not have any of them on our list because of the long permitting process in Canada. The price of lithium that is vital to the energy transition has plunged by around 80% since late 2022, as the market whiplashed from shortage fears to a mountain of surplus inventories. Nickel and cobalt have also tumbled, weighed down by an influx of new production amid concerns that the shift to electric vehicles may not be as smooth and quick as predicted. Consequently, we do not expect any critical minerals’ producers to appear on 2024 ranking. The last incident was vanadium producer, Largo, in last year’s runners-up list.

Teck’s recent strategic transitions and offloading of assets may lead to the company losing revenue and dropping a few places in the 2024 ranking.

According to a recent article on our sister site, mining.com, Newmont and Barrick Gold, the top two gold miners of the world, are expected to post higher quarterly profits, powered by a rally in the precious metal’s prices.

Rising hopes of interest rate cuts, uncertainty around U.S. elections, and global geopolitical risks have boosted the precious metal’s safe-haven appeal, pushing it to a record-high level.

Finally, we expect the notable departure of Victoria Gold from next year’s ranking, as the recent incident in the Yukon may lead to a sharp decline in revenues in 2024.

Comments