Anglo American to sell De Beers, Amplats after BHP latest bid

Anglo American (LON: AAL), the takeover target of mining giant BHP (ASX: BHP), has ceded to pressure from investors announcing plans to sell some of its legacy assets in an attempt to protect itself from current and future bids.

The sweeping break up plan, disclosed on Tuesday, will see Anglo American sell its diamond business De Beers, its South Africa-based Anglo American Platinum (Amplats) (JSE: AMS), and its steelmaking coal assets.

The company, which rejected on Monday BHP’s US$43 billion takeover official offer, is keeping its copper, iron ore and crop nutrients businesses. Anglo American owns three of the top 10 producing copper mines in South America, with ample room for growth. It is also a main producer of premium iron ore, which has historically accounted for the lion’s share of Anglo’s profit, and it will decrease investments in its recently acquired fertilizers business from £1 billion (US$1.26 billion) to £200 million (US$251 million) in 2025.

The next step will be to find strategic investors who can support the resumption of full-scale operations on the Woodsmith polyhalite project, starting in 2026, chief executive Duncan Wanblad said.

While the 107-year-old miner was already in the midst of its own review of assets, the timeline had to be speeded up after BHP’s sweetened bid, Wanblad said. The overhaul, described by Wanblad as a “clear, compelling and decisive plan”, will unlock value for Anglo’s shareholders by creating a “radically simplified” company focused on “world-class assets”, he noted in a media call following the announcement.

“These actions represent the most radical changes to Anglo American in decades,” Wanblad added.

The executive said Anglo American will be “extremely highly valued” by the end of 2025 when the restructuring is complete, “to the extent that anybody wants to buy us at that particular point in time, they are going to have to pay an enormous amount of money for it.”

The sudden announcement is viewed by some analysts as a strategy to attract interest from other potential buyers for the company's non-core divisions, and also to discourage BHP's aggressive takeover attempts.

“Those assets that would be put up for sale will most certainly appeal to competitors, some in aggregate (perhaps forcing an offer for the group, like BHP is attempting, before it breaks itself up) and some in part,” energy and mining analyst at Quilter Cheviot, Jamie Maddock, said in a note.

BMO analyst Alexander Pearce said that just reducing the spend on Woodsmith may be enough for a reasonable re-rating on Anglo American. “The intention to accelerate strategic changes is likely to be well-received, albeit the company would be less differentiated vs. peers.”

Pearce noted the Anglo’s plans have a target of US$1.7 billion in cost savings thanks the new portfolio configuration, including US$800 million cost savings from the end of 2025.

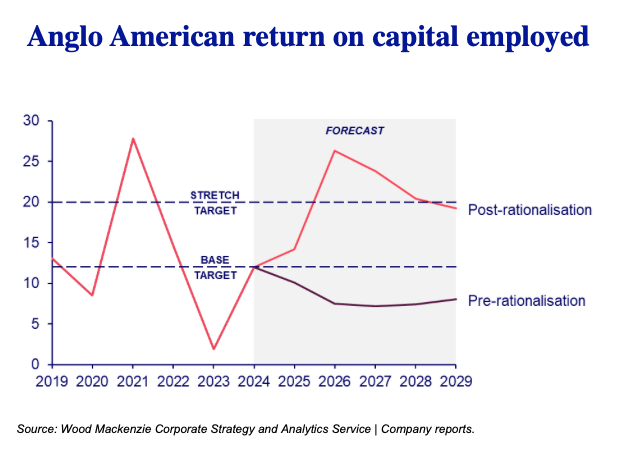

The move will take Anglo from being the most diversified to the most concentrated major miner, according research firm Wood Mackenzie.

“We believed that a major reshuffling of Anglo American's portfolio was inevitable,” said Wood Mackenzie's James Whiteside, metals and mining corporate research director. “But opting to divest or demerge whole segments of its portfolio does align with the company’s new strategic priorities.”

De Beers, the world’s largest diamond producer by value, was founded in 1888 in South Africa by British mining magnate Cecil Rhodes. The company was partially owned by the Oppenheimer dynasty, which also founded Anglo American, until the family sold their 40% stake to Anglo American itself in 2012.

The diamond producer used to be the prized possession of Anglo's extensive business empire. It held a dominant position in the global precious stones market in terms of both overall sales and public perception, due to the long-lasting impact of its "A diamond is forever" campaign from the 1940s.

The diamond sector, and De Beers in particular, has faced challenges in the past three years due to declining sales, a sluggish global economy, and the rise of lab-created diamond alternatives.

Mark Wanblad said De Beers remained "a great business" and noted the unit had already attracted interest from prospective investors, without mentioning names.

Anglo’s CEO expressed confidence that the "structural issues" facing the diamond industry will be resolved. “There’s no doubt in our mind that the structural issues that everyone talks about will pass,” he said.

The company’s bold move may thwart BHP’s plans of turning itself into a copper giant, controlling about 10% of the metal global production at time when an urgent shift to a greener economy is boosting both prices and demand.

Wood Mackenzie highlighted that iron ore and copper have been outsized cash generators for Anglo over the last five years, delivering 58% of the company’s underlying earnings before interest, taxes, depreciation, and amortization (EBITDA).

“Looking forward, even without fresh investment, copper will overtake iron ore in cash generation and this would allow Anglo American to use the proceeds to focus on brownfield growth at these core assets,” Whiteside said.

South African mining minister Gwede Mantashe told the Financial Times that he would prefer Anglo’s restructuring plan over a BHP-driven split and takeover. “I am happy with the rejection of the BHP deal and I hope it will continue, then Anglo can restructure itself to optimize value for shareholders,” he said.

The minister's support is crucial as it reflects the government's stance on the restructuring of a major player in the country's mining industry.

The Church of England Pensions Board, a UK asset owner and long-term shareholder in Anglo American, was also pleased with today's announcement.

“We need more companies like Anglo that are willing to grasp the opportunities of operating in emerging and developing markets such as Africa, not fewer,” it said in a statement. “As a UK pension fund, we are keen that the London Stock Exchange remains a premium market for mining companies.”

Activist fund Elliott, one of Anglo's top 10 shareholders after building up a US$1 billion stake, is expected to put out a statement later in the day.

Ashwin Pillay, senior associate at Charles Russell Speechlys law firm, said the new plan addresses shareholder concerns regarding the undervaluation of Anglo's copper mines due to less valuable operations like the diamond division. He also pointed out that there is still a chance for BHP to increase its offer, potentially by including a cash component to make the deal more appealing.

Analysts believe Anglo American could easily obtain US$25 billion in asset value through divestment or demerger (gross of exit costs) of its other commodities assets such as platinum, steelmaking coal and nickel over the next few years. For Wood Mackenzie, this represents a potential uplift of US$9.1 billion over the research firm's base net asset value (NAV).

Experts warn that executing Anglo American's strategic plan will not be easy. By showing a willingness to deconstruct the company, the company has given credibility to BHP's proposed takeover, potentially making it more palatable to regulators in key markets such as South Africa, Wood Mackenzie's Whiteside said.

Whiteside concludes that Anglo American's strategic plan is undoubtedly bold, and shedding the equivalent of 39% of 2024 earnings would be transformational. However, the execution risk is substantial and borne entirely by Anglo American shareholders. If an increased offer from BHP did materialize, it could be seen as a more straightforward option for shareholders.

“Anglo American's strategic plan is undoubtedly bold and shedding the equivalent of 39% of 2024 earnings would be transformational,” Whiteside concludes. “However, execution risk is substantial and borne entirely by Anglo American shareholders so if an increased offer from BHP did materialise, it could be seen as a more straightforward option for shareholders.”

Shares in Anglo American fell on the news and were down 2.8% to 2,632p by mid-afternoon in London, leaving the company with a market capitalization of £35.2 billion (US$44.3 billion).

Comments