Prefeasibility for FPX Nickel’s Baptiste project puts NPV over $2.7 billion

FPX Nickel (TSXV: FPX; OTCQB: FPOCF) certainly must be pleased with the prefeasibility study (PFS) for its Baptiste nickel development. The study gives the project an after-tax net present value at an 8% discount of almost $2.75 billion (US$2.01 billion). The after-tax internal rate of return using a nickel price of US8.75/lb. is 18.6%.

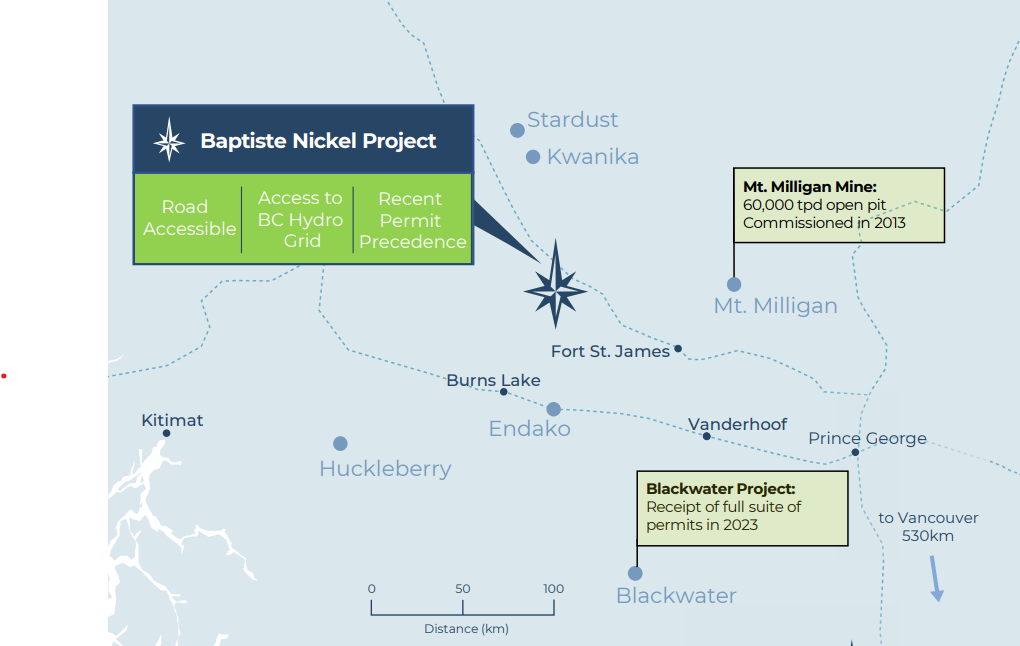

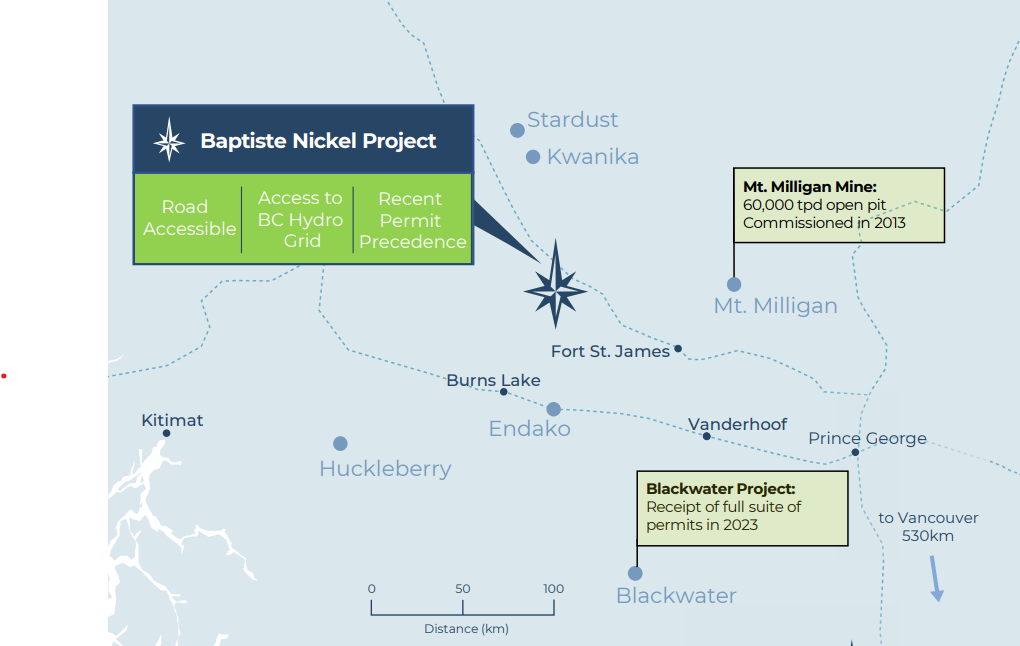

The Baptiste deposit is part of FPX’s Decar project 90 km northwest of Fort St. James in central British Columbia. The company intends to develop a high-margin, long-life, large-scale, and low-carbon mine. It will produce a 60% nickel concentrate for direct feed into the stainless steel industry. The project could also produce battery-grade nickel sulphate, cobalt precipitate, and copper concentrates products with additional refining.

"The PFS firmly establishes Baptiste as a key strategic asset in the development of Canada's critical minerals supply chain," said Martin Turenne, FPX's president and CEO. "Despite the inflationary pressures observed in the mining industry in recent years, the study has yielded after-tax NPV and IRR superior to those observed in the 2020 preliminary economic assessment, reflecting greater engineering maturity and incorporating the several optimizations identified by our class-leading project team in regard to resource modelling, mine planning, process recovery, and site design."

The base case PFS outlines an open pit mine producing 59,100 tonnes of nickel annually in concentrate over a 29-year mine life. Conventional open pit development will occur in phases beginning with an initial milling rate of 108,000 t/d. Mill capacity will grow to 162,000 t/d in the second phase funded from free cash flow after the after-tax payback period of 3.7 years.

The mill flowsheet will be conventional, using SAG milling followed by magnetic separation, froth flotation, and a flotation tailings leach circuit. The tailings circuit will produce a mixed hydroxide precipitate.

Proven and probable reserves at the Baptist deposit total 1.5 billion tonnes averaging 0.21% nickel and containing 6.89 billion lb. of nickel.

FPX estimates that initial capital expenses will be $2.97 billion plus sustaining costs of $1.61 billion. The expansion costs will be $1.04 billion, and the closure capital cost will be $387.8 million.

The PFS puts the all-in sustaining cost per pound of nickel produced at US$4.17. During the first phase, the AISC is expected to be US$3.97 and during the second phase at US$4.23.

The corporate presentation posted on www.FPXNickel.com has more detailed information.

Comments