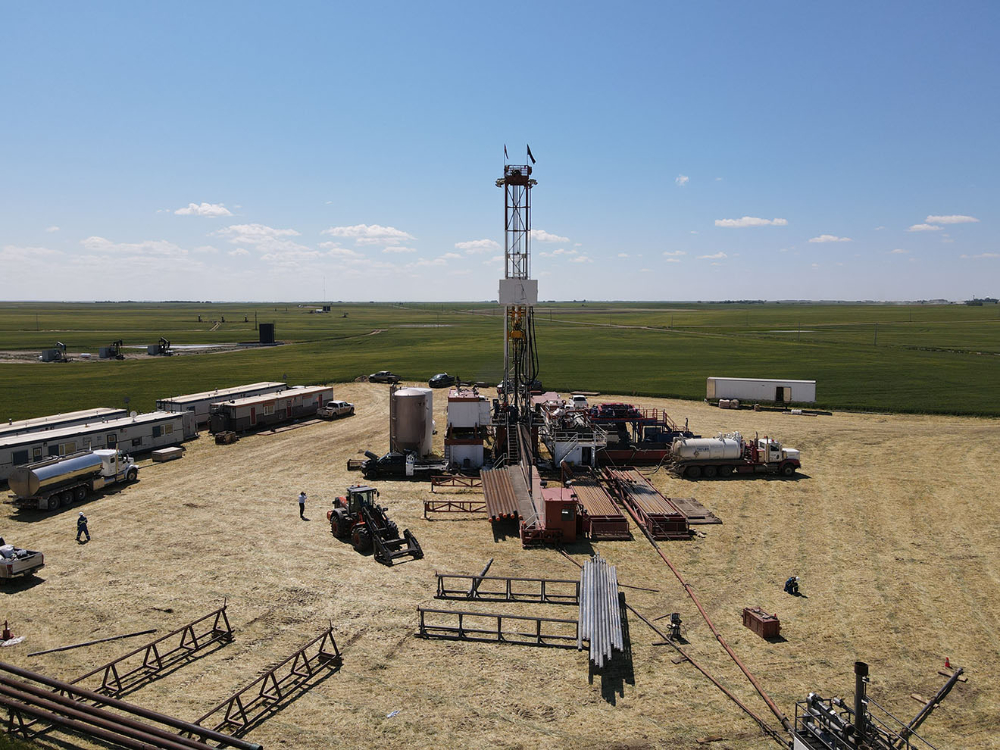

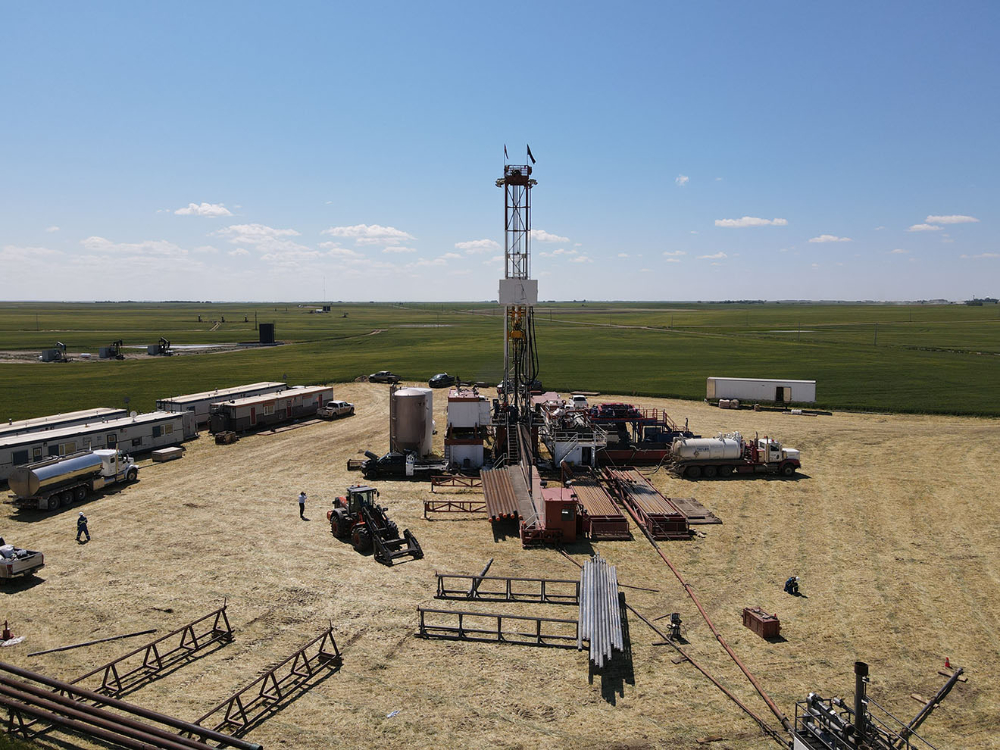

Kindersley PEA outlines ‘strong’ economic case for Sask. lithium project

Canadian Mining Journal Staff

Grounded Lithium (TSXV: GRD; OTCQB: GRDAF) reports its preliminary economic assessment (PEA) for the Kindersley lithium project demonstrates a strong economic case for producing battery-grade lithium hydroxide monohydrate (LHM), with potential for future phases.

Phase one of the project in Saskatchewan includes an after-tax internal rate of return (IRR) of 48.5% and an after-tax net present value (NPV) of US$1.0 billion at an 8% discount rate. The initial capital investment for the project is estimated at US$335 million, with a payback period of 3.7 years.

The company says Kindersley stands out with a lower capital intensity compared to other North American brine-based lithium projects, with an initial capital intensity of US$30,500 per tonne of LHM. The projected all-in operating costs are US$3,899 per tonne of LHM, amounting to an annual expenditure of US$42.9 million.

The PEA is based on an annual production of 11,000 tonnes of LHM, and assumes a sales price of US$25,000 per tonne.

Grounded Lithium president and CEO Gregg Smith said, “The independent economic results of phase one of the KLP compare favourably within the lithium mining industry from a capex and opex perspective and we believe the results of the PEA bode well for critical future steps.”

For more information, visit www.GroundedLithium.com.

Comments