Max Resource closes $15.3M financing for Cesar drilling in Colombia

Max Resource (TSXV: MAX; OTC: MXROF) has raised $15.3 million through a private placement of 25.5 million units at a price of $0.60 per unit. Each unit comprises one common share and one common share purchase warrant, with each warrant exercisable for one year at a price of $0.85.

Net proceeds of this financing will be used for drilling and exploration of the company's flagship Cesar copper-silver project in Colombia, a district-scale property situated along the northern portion of the Andean belt.

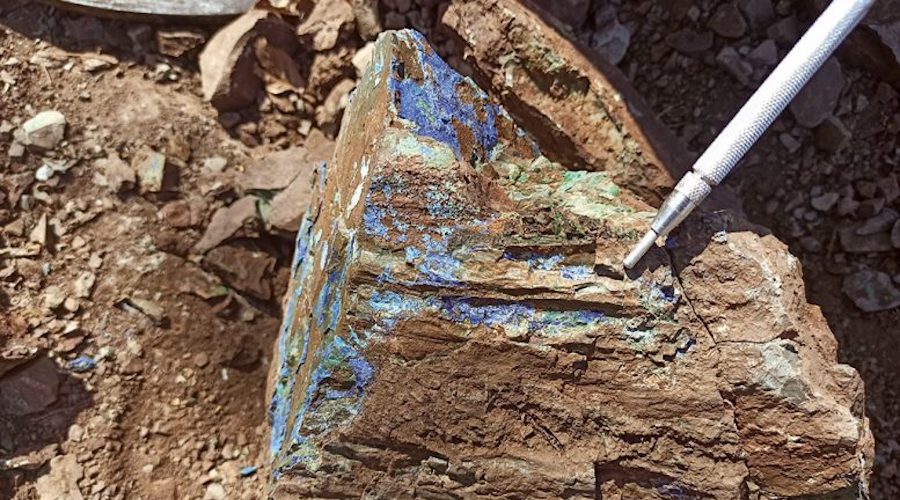

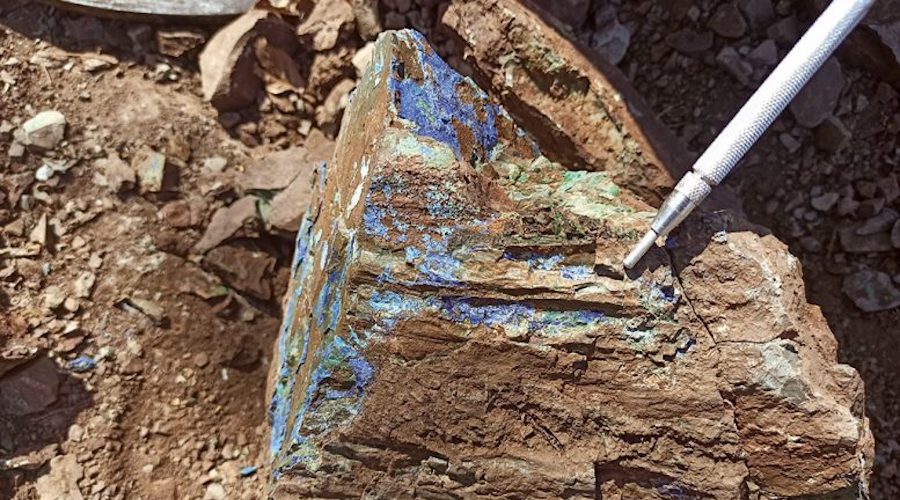

Max presently holds over 170 sq. km. of approved mining concessions within the project area, covering three high-grade discoveries (Uru, Conejo and AM) made by the exploration team since acquiring the project in late 2019.

Current focus is placed on the approximately 70 sq. km. URU discovery zone, where Max is planning an initial drill program to test the scale and continuity of strong copper mineralization at depth. Assay results from ongoing sampling have led to multiple drill targets being identified at URU this year.

In addition to Cesar, Max also controls the RT gold project (100% earn-in) in Peru, encompassing a bulk tonnage primary gold porphyry zone and a gold-bearing massive sulphide zone. Historic drilling at RT in 2001 returned values ranging 3.1 to 118.1 g/t gold over core lengths ranging from 2.2 to 36.0 metres.

For more information on Max's projects, visit www.maxresource.com.

Comments