Crescat Capital acquiring 19.9% stake in Goliath Resources

Crescat Capital LLC, a Denver-based asset management firm, is acquiring up to 19.9% of Goliath Resources (TSXV: GOT), post funding of the private placement announced by the company last week.

The financing involved the placement of flow-through units priced at C$1.19 for gross proceeds of C$11 million. Each unit comprised one common share of Goliath, plus one common share purchase warrant exercisable at C$1.30 for a two-year period.

In addition, Crescat will have an option to participate in future financings to maintain its interest, as long as it holds greater than 3% of Goliath's issued and outstanding common shares.

Crescat now joins Canadian billionaire Eric Sprott, who made a C$2 million investment this time last year, as notable strategic investors in the company.

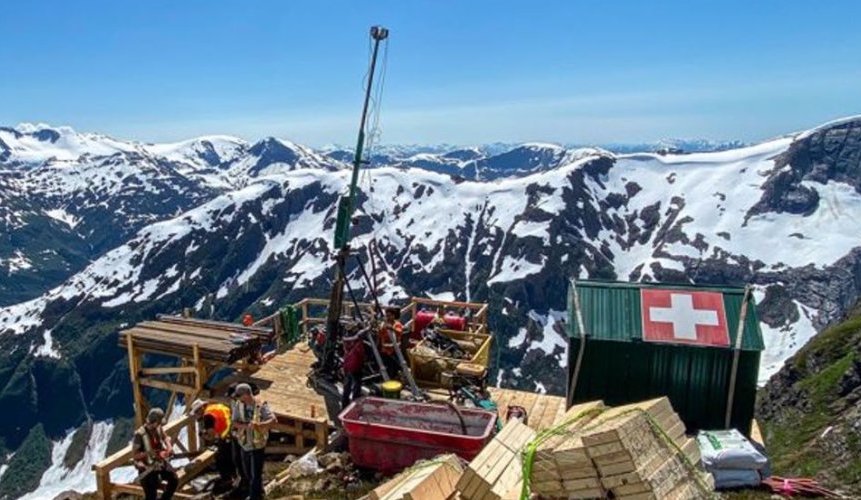

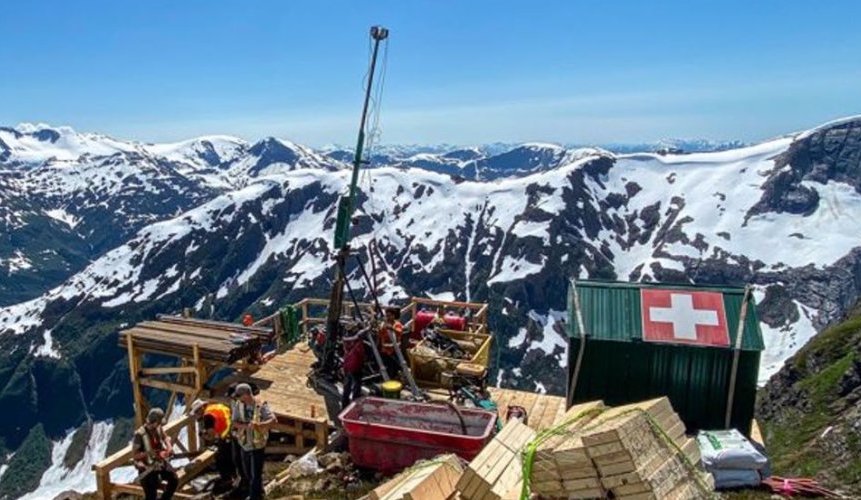

Proceeds of the financing will be used to fund Goliath's planned 2022 drill campaign at Surebet, a newly discovered high-grade polymetallic gold-silver shear zone at the Golddigger project in BC. This will include drill testing the outer extremities of the Surebet zone to determine the potential size of the system.

In 2021, Goliath completed a 5,332m maiden drill campaign, where 100% of all 24 holes intercepted significant mineralization over 1 km of strike and 1.1 km of down dip extension on the Surebet discovery. The average grade and width from the best hole assayed 9.42 g/t AuEq (6.66 g/t Au and 172.66 g/t Ag) over 6.43m respectively.

Shares in Goliath Resources saw a moderate gain of 1.0% by 12:20 p.m. on the TSX Venture Exchange. The gold junior has a market capitalization of C$52.2 million.

This article was originally posted on www.Mining.com.

Comments