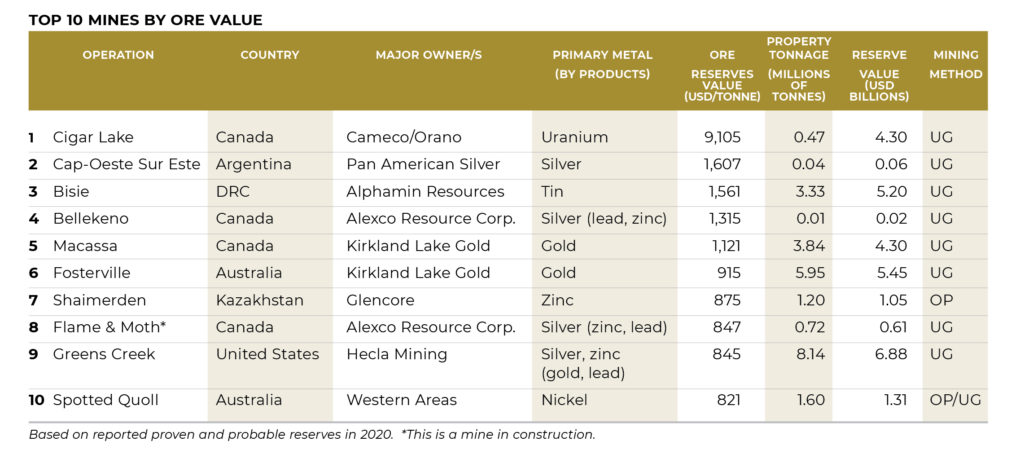

Ranked: Top 10 mines with the world’s most valuable ore

Mining Intelligence data shows that Canada hosts several of the top mines by ore value

In mining, grade is king. Across the commodity spectrum, some of the most anticipated results – which can determine the scope of a mining project – are assay values from drill testing.

As one of mining’s most influential figures, Robert Friedland, sums it up:

“Mining 101. High grade is good. Low grade is bad.

“The higher the grade, the smaller the environmental footprint,” Friedland has said. “The higher the grade, the smaller the plant, the less the electrical consumption, the smaller the labour force, the smaller the tailings pond, the less the global warming gas per unit of metal produced.”

two deposits on the list. CREDIT: ALEXCO RESOURCE

mine in Australia. CREDIT: KIRKLAND LAKE GOLD

The value of the ore is calculated by multiplying the contained metals and minerals per tonne in the proven and probable reserves by the ruling price for the commodities.

While this isn’t a measure of profitability since it does not take costs of development or operation into account or the overall size of the mine, it does offer insight into the geographical locations that host rich ore and commodities of interest.

Silver and gold shine on the top ten list of mines with the most valuable ore, compiled with data provided by our sister company Mining Intelligence.

Top listed uranium producer Cameco’s Cigar Lake uranium mine in Saskatchewan takes top spot with ore reserves valued at US$9,105 per tonne, totalling US$4.3 billion. After a six-month pandemic induced halt, Cameco restarted operations at Cigar Lake in April.

Pan American Silver’s Cap-Oeste Sur Este (COSE) mine in Argentina is in second place, with ore reserves valued at US$1,606 per tonne, totaling US$60 million.

In third place is Alphamin Resources’ Bisie tin mine in the Democratic Republic of Congo, which saw record production in the final quarter of 2020, with ore reserves valued at US$1,560 per tonne, totalling US$5.2 billion. Fourth place goes to Alexco Resource’s Bellekeno silver mine in Canada’s Yukon territory, one of four deposits that make up its Keno Hill operation. Reserves at Bellekeno are valued at US$1,314 per tonne for a total value of US$20 million.

Kirkland Lake Gold, which recently announced it will merge with Agnico Eagle Mines, takes two spots in the top ten list, with its Macassa gold mine in Ontario and Fosterville gold mine in Australia at fifth and sixth places, respectively. Macassa has ore reserves valued at US$1,121 per tonne for a total value of US$4.3 billion while Fosterville’s reserves are valued at US$915 per tonne for a total of US$5.5 billion.

In seventh place is Glencore’s Shaimerden zinc mine in Kazakhstan, with ore reserves valued at US$874.7 million for a total value of US$1.1 billion. Alexco Resource takes another spot with its Flame and Moth silver deposit at Keno Hill with reserves valued at US$846.9 per tonne, for a total value of US$610 million.

Rounding out the top ten are Hecla Mining’s Greens Creek

silver-zinc mine in Alaska with ore reserves valued at US$844 per tonne for a total value of US$6.9 billion. Western Areas Spotted Quoll nickel mine in Australia with ore reserves valued at US$821 per tonne – a total value of US$1.3 billion.

This article first appeared on www.mining.com. Visit www.miningintelligence.com for more information.

Comments

Erin Legault

Grade is one thing, but need to look at the overall resource. I can’t see a mine being built with only 40,000 (2nd spot) and 10,000 (4th spot) tonnes regardless of the grade.