Tony Makuch wants to change the popular perception of gold mining: ‘We’re the good guys’

Kirkland Lake Gold is in the midst of one of the Canadian gold sector’s most important mergers in recent memory with Agnico Eagle Mines.

And on Oct. 13, Kirkland Lake CEO Tony Makuch – and soon-to-be CEO of the new Agnico Eagle – joined Canadian Mining Journal’s first Reimagine Mining Symposium as a keynote speaker to talk about the mega-merger.

“It’s a strength-on-strength transaction,” putting together two leaders in the gold space that have a demonstrated track record of growing per share value, he told moderator Henry Lazenby, multimedia content producer with CMJ’s sister publication, The Northern Miner.

The deal, announced on Sept. 28, will create a high quality, senior producer with 48 million oz. of gold in reserves. The boards of both companies have approved the arrangement, which is expected to close late this year or in early 2022, and current Agnico CEO Sean Boyd will become chair of the board.

The merged company will be the world’s third largest gold producing company with about 3.5 million oz. per year at all-in sustaining costs of around US$810-820 per oz. Makuch believes that can be further reduced to below US$800 per oz. through synergies and other opportunities.

The companies have touted US$2 billion worth of savings through synergies including sharing exploration knowledge, technology, processing opportunities, infrastructure, and the support of local communities and regulators both Agnico Eagle and Kirkland Lake have earned.

“Unlocking technology will play a big part in reducing costs,” Makuch said. “We rely on exploration technology to drive value in our industry. . . If we can find an ounce of gold for US$5 or US$10, then upgrade the resources for US$150 an ounce, you have created value.”

Profitable and responsible

Makuch also noted that the two companies have similar cultures and are motivated to demonstrate leadership in best practices, people management, environmental stewardship and corporate governance which result in industry-leading returns for shareholders.

In addition to creating value through synergies, Makuch said the combined company could rehabilitate the gold mining industry’s reputation for sustainability in the minds of investors.

“When it comes to ESG or the perception of gold mining in the global investment market, we think we’ve got a unique opportunity to enhance or change the perception of what gold mining is,” Makuch said. “These can be profitable businesses that are responsibly run.”

Makuch added that “we are actually the good guys – and good girls too.”

Merger with Agnico

Makuch also fielded questions from the audience, including those about why Agnico Eagle did not offer a sizeable premium on the Kirkland Lake share price. The merger is worth an estimated $13.5 billion as Kirkland Lake shareholders will receive 0.7935 of an Agnico Eagle common share for each of their shares.

“Kirkland Lake Gold has a track record of growing itself as a company,” he said. “In making a premium deal, you have to see new value that can be created. If we insisted on a premium, it’s the same as me saying to shareholders we haven’t created the value we could have for you.”

Kirkland Lake operates the Macassa and Detour Lake gold mines in Ontario and the Fosterville gold mine in Victoria, Australia. Agnico Eagle’s assets include the Meadowbank, Canadian Malartic (50% interest), Goldex, Hope Bay, LaRonde and Meadowbank gold mines in Canada. The company also has gold mines in Mexico (Pinos Altos and La India), and Finland (Kittila).

Of note, the two companies see opportunity for significant growth in the Abibiti gold belt, where many of their operations are located, representing around 1.9 million oz. of production.

For example, there could be an opportunity to leverage infrastructure at Kirkland Lake’s Macassa to bring forward development of Agnico’s Upper Beaver deposit, about 10 km to the east.

The merged company is expected to continue to prioritize exploration.

“The new Agnico Eagle is always going to be an aggressive explorer, and we have the capital resources to do tyhat,” Makuch said.

‘Smart mine’ status

Makuch also expects to speed up the adoption of new technology. Kirkland Lake is currently building a private 5G network at Detour mine and underground at Macassa, while Agnico already has infrastructure for a private area network at LaRonde.

“They’re a step ahead in terms of getting everything digitized and automated,” Makuch said. Building on Agnico’s learnings and expertise around new technology, Macassa and Detour can also be fast-tracked toward “smart mine” status.

The merged Agnico-Kirkland Lake will maintain the goal of net-zero carbon emissions by 2050 or before.

“We can get to net zero if we close all our mines,” Makuch said, “but we want to operate our mines.” That means improving processes, going electric, adopting smart technologies, and always seeking sustainability.

While not all of the merged company’s 12 mines operating today will make it to 2050, the company is aiming to extend the mine lives of 50-75% of them to 2050.

The first step to net zero is understanding the company’s carbon footprint operation by operation, Makuch said,

“We’ve been going through a lot of analysis, looking at (that).”

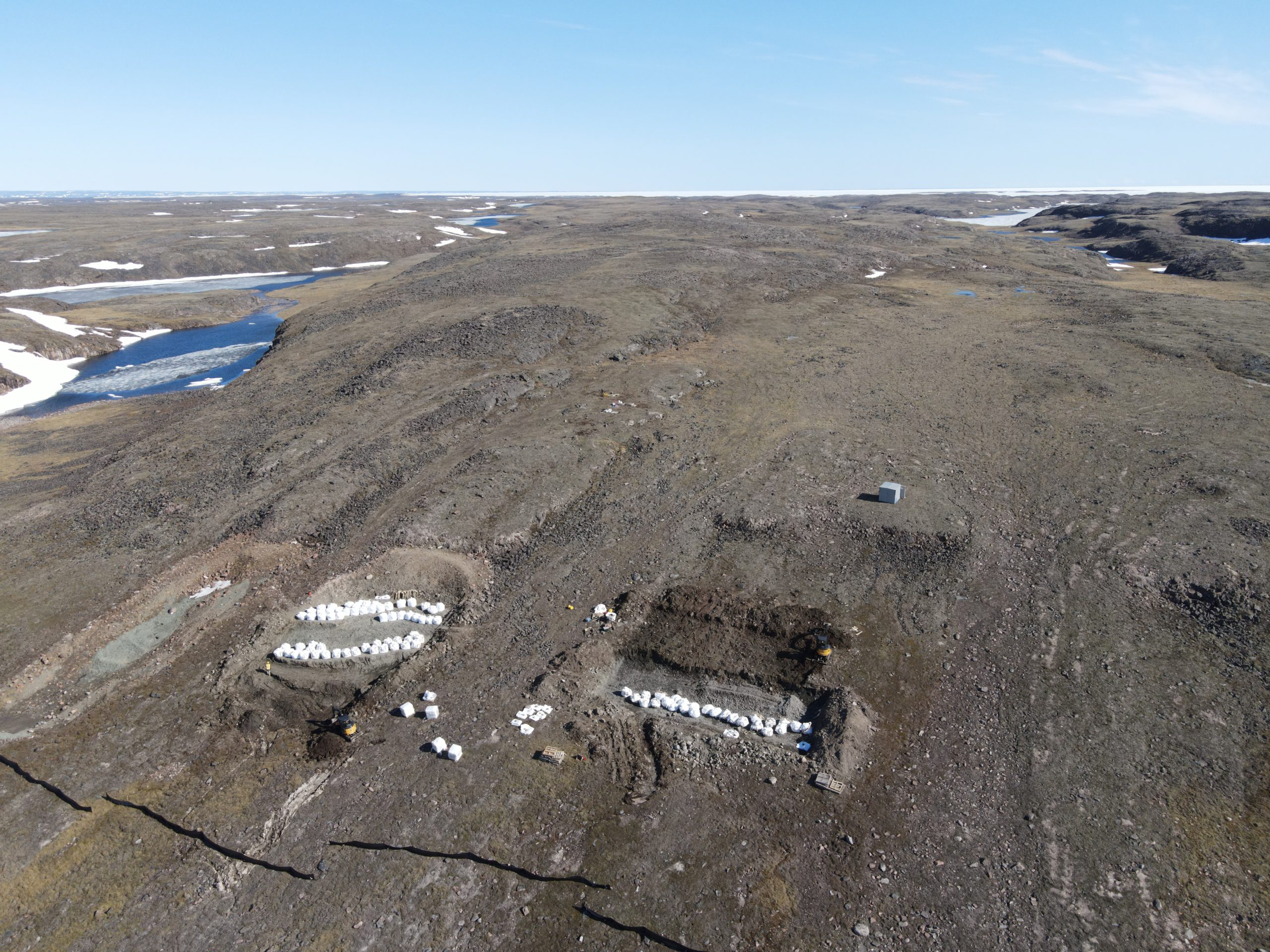

While Detour Lake is on the grid, Agnico’s Nunavut operations rely on diesel, Makuch said, noting “there’s not one single way to get (to net zero).”

Check out videos from the Reimagine Mining Symposium, including our decarbonization panel, SRK’s thought leadership panel ‘What if mining was cool?‘ and our interviews with Don Duval and George Hemingway. Pick up our December issue for more coverage of the event.

Comments

Frank Bruce

Very Proud to be an Employee at KLGOLD and having Tony at the head of the table makes it all the better!