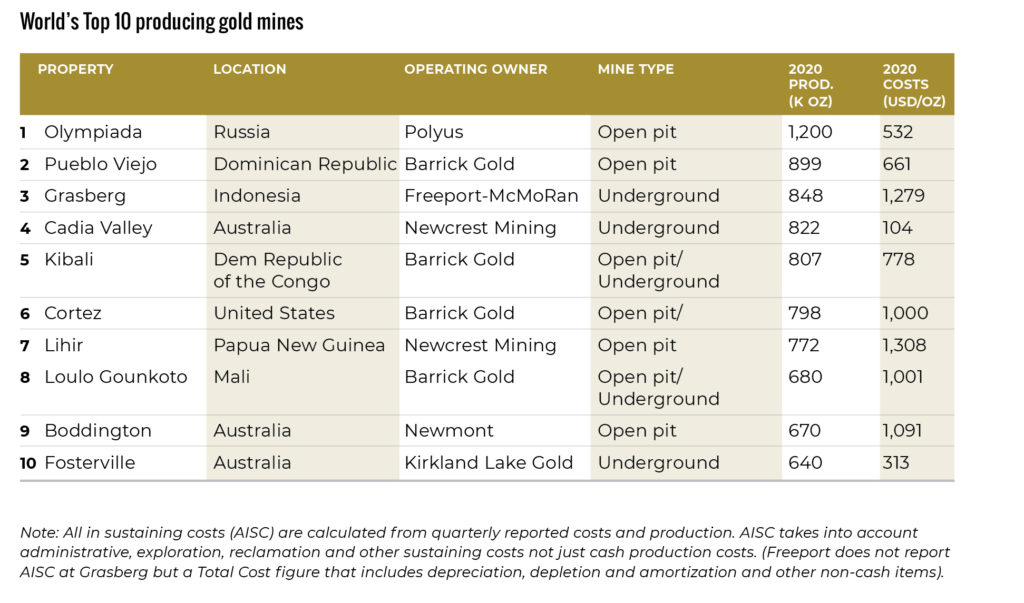

The world’s top 10 gold mines

MiningIntelligence data shows that Australia hosts three

of the most prolic gold producers

Despite being adversely affected by the Covid-19 pandemic, global gold production still surpassed 100 million ounces in 2020 and is expected to bounce back this year as economies continue to recover and miners ramp up operations.

To see which mining operations were the biggest contributors to the world’s gold output, MINING.com and sister company Mining Intelligence collaborated to provide a ranking of the top gold producers based on production for the 2020 calendar year.

Taking top spot is Polyus’s largest mining operation, Olimpiada, located in one of Russia’s most prolific gold mining provinces. The mine began production in 1996 and currently accounts for nearly half of the Moscow-based company’s total gold output. Even though production in 2020 was impacted by a decline in ore grades processed, resulting in a 14% year-on-year decline, Olimpiada was still the world’s most prolific gold producer.

In second place is a Barrick-Newmont joint venture, Pueblo Viejo in the Dominican Republic, located about 100 km northwest of the capital city of Santo Domingo. Project development started in 2009, and reached first production in 2012. Barrick Gold previously announced that it would spend US$1.3 billion to extend the mine’s life and unlock over 11 million ounces of gold reserves.

Once the world’s top producer, the giant Grasberg mine operated by Freeport-McMoRan in the Indonesian province of Papua fell to third place this past year. In 2020, mine production was cut by rising Covid-19 infections in the region, which resulted in a reduction in workforce. At its peak in 2001, the mine complex produced more than 3.5 million ounces of gold for the year.

In fourth place is Newcrest Mining’s Cadia Valley operations in New South Wales, Australia. Cadia Valley comprises the Cadia East underground panel cave mine and the Ridgeway underground mine, currently on care and maintenance. In October 2020, an expansion of the Cadia mine was approved, which would see output rise by 1.8 million oz. over its mine life. Cadia’s low all-in sustaining costs (AISC) benefited from mined copper and molybdenum production credits as well as the timing of sustaining capital expenditure.

Taking fifth place is the Barrick-operated Kibali mine in the Democratic Republic of the Congo. Kibali, the first underground mine to be built in the African nation, is currently one of the world’s most highly automated underground gold mines. In the third quarter of 2020, Barrick integrated a new battery technology into the mine’s power grid, further reducing its energy costs and carbon footprint.

Rounding out the rest of the rankings are: Cortez in Nevada (Barrick), the Lihir mine in Papua New Guinea (Newcrest), Loulo Gounkoto in Mali (Barrick), the Boddington open-pit mine in Australia (Newmont), and the Fosterville underground mine (Kirkland Lake Gold), also in Australia.

Notable omissions from the list include the Muruntau mine operated by Uzbekistan’s Navoi Mining & Metallurgical Combinat. We omitted Murantau because the miner does not disclose production data or AISC figures. MiningIntelligence estimates gold production to be about 2 million oz. each year, which makes it the biggest gold mine in the world.

Another omission is Barrick’s Carlin Trend operations in Nevada, jointly owned with Newmont. As the reported production figures from Carlin of 1.67 million oz. in 2020 is an aggregated production number from numerous operations, MiningIntelligence could not determine which of the operations within this large cluster of mines contributed the most gold.

This article first appeared on www.mining.com.. Visit www.miningintelligence.com for more information.

Comments