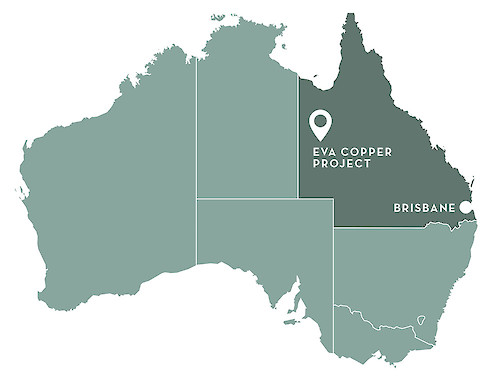

[caption id="attachment_1003735411" align="alignnone" width="500"]

Location of Copper Mountain Mining's Eva project, in Queensland, Australia. Credit: Copper Mountain Mining[/caption]

VANCOUVER –

Copper Mountain Mining has improved the economics of its Eva copper project in Queensland, Australia, with an updated feasibility study showing a longer mine life, increased production and lower cash costs.

Compared with a feasibility completed in 2018, the new study has increased the mine life by three years to 15 years, boosted annual production by 25% to 100 million lb. copper, and decreased cash costs by 17% to US$1.44 per lb. copper after byproduct credits.

With an initial capex of US$382 million (up from US$350 million in the 2018 study), the open pit project is forecast to produce an after-tax net present value of US$437 million and an internal rate of return of 29%, using a discount rate of 8%. Total capital investment is pegged at US$492 million.

“These results demonstrate the high quality nature of the Eva Copper Project,” said Gil Clausen, Copper Mountain’s president and CEO in a release. "Eva Copper has the potential to add significant production and cash flow to our existing solid operating base. While we are and will continue to add value to Eva Copper, it should be noted that we will only move forward with development in the right copper price environment. Eva provides Copper Mountain shareholders with high-quality organic growth potential in a low risk jurisdiction.”

Since the original feasibility study, Copper Mountain has added the Blackard and Scanlan deposits into its reserve count, increasing total reserves by 46%.

A total of seven deposits will be mined at Eva, producing an average of 100 million lb. copper and 13,650 oz. gold annually. Total ore mined is expected to be 170 million tonnes and total waste 380 million tonnes, for a waste to ore strip ratio of 2.2 to 1. Overall copper recoveries are estimated at 87%.

The process plant, which incorporates a larger ball mill than in the original study, and will feature a secondary crusher and high-pressure grinding roll (HPGR) design (instead of a SAG mill and pebble crushing circuit as originally planned), is designed to handle 31,200 t/d (11.4 million t/y). Mining from the various deposits will be sequenced to deliver a 3:1 ratio of sulphide copper ore to native copper ore. Copper and gold concentrate produced at Eva will be shipped to

Glencore's Mt. Isa Smelter, 194 km southwest.

The study uses prices of US$2.97 per lb. copper and US$1,466 per oz. gold in year one, and longer term prices of US$3.04 per lb. copper and US$1,362 per oz. gold. An Australian dollar to U.S. dollar rate of 1.55:1 is used.

Eva hosts proven and probable reserves of 171 million tonnes grading 0.46% copper and 0.05 g/t gold for 1.7 billion lb. copper and 260,000 oz. gold.

Copper Mountain also has a 75% interest in the producing Copper Mountain mine in British Columbia, where operations have continued at reduced mining rates during the COVID-19 pandemic.

Mitsubishi Materials Corp. holds the remaining 25% stake.

For more information, visit

www.cumtn.com.

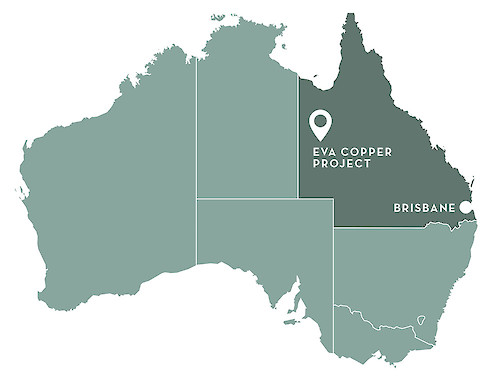

Location of Copper Mountain Mining's Eva project, in Queensland, Australia. Credit: Copper Mountain Mining[/caption]

VANCOUVER – Copper Mountain Mining has improved the economics of its Eva copper project in Queensland, Australia, with an updated feasibility study showing a longer mine life, increased production and lower cash costs.

Compared with a feasibility completed in 2018, the new study has increased the mine life by three years to 15 years, boosted annual production by 25% to 100 million lb. copper, and decreased cash costs by 17% to US$1.44 per lb. copper after byproduct credits.

With an initial capex of US$382 million (up from US$350 million in the 2018 study), the open pit project is forecast to produce an after-tax net present value of US$437 million and an internal rate of return of 29%, using a discount rate of 8%. Total capital investment is pegged at US$492 million.

“These results demonstrate the high quality nature of the Eva Copper Project,” said Gil Clausen, Copper Mountain’s president and CEO in a release. "Eva Copper has the potential to add significant production and cash flow to our existing solid operating base. While we are and will continue to add value to Eva Copper, it should be noted that we will only move forward with development in the right copper price environment. Eva provides Copper Mountain shareholders with high-quality organic growth potential in a low risk jurisdiction.”

Since the original feasibility study, Copper Mountain has added the Blackard and Scanlan deposits into its reserve count, increasing total reserves by 46%.

A total of seven deposits will be mined at Eva, producing an average of 100 million lb. copper and 13,650 oz. gold annually. Total ore mined is expected to be 170 million tonnes and total waste 380 million tonnes, for a waste to ore strip ratio of 2.2 to 1. Overall copper recoveries are estimated at 87%.

The process plant, which incorporates a larger ball mill than in the original study, and will feature a secondary crusher and high-pressure grinding roll (HPGR) design (instead of a SAG mill and pebble crushing circuit as originally planned), is designed to handle 31,200 t/d (11.4 million t/y). Mining from the various deposits will be sequenced to deliver a 3:1 ratio of sulphide copper ore to native copper ore. Copper and gold concentrate produced at Eva will be shipped to Glencore's Mt. Isa Smelter, 194 km southwest.

The study uses prices of US$2.97 per lb. copper and US$1,466 per oz. gold in year one, and longer term prices of US$3.04 per lb. copper and US$1,362 per oz. gold. An Australian dollar to U.S. dollar rate of 1.55:1 is used.

Eva hosts proven and probable reserves of 171 million tonnes grading 0.46% copper and 0.05 g/t gold for 1.7 billion lb. copper and 260,000 oz. gold.

Copper Mountain also has a 75% interest in the producing Copper Mountain mine in British Columbia, where operations have continued at reduced mining rates during the COVID-19 pandemic. Mitsubishi Materials Corp. holds the remaining 25% stake.

For more information, visit

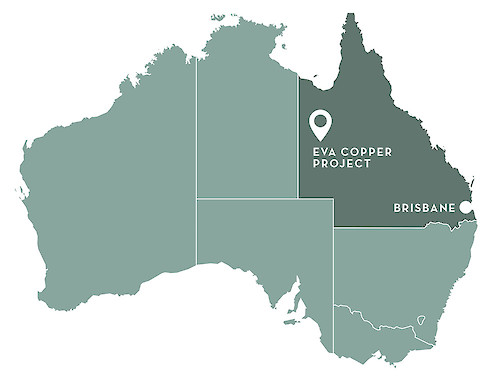

Location of Copper Mountain Mining's Eva project, in Queensland, Australia. Credit: Copper Mountain Mining[/caption]

VANCOUVER – Copper Mountain Mining has improved the economics of its Eva copper project in Queensland, Australia, with an updated feasibility study showing a longer mine life, increased production and lower cash costs.

Compared with a feasibility completed in 2018, the new study has increased the mine life by three years to 15 years, boosted annual production by 25% to 100 million lb. copper, and decreased cash costs by 17% to US$1.44 per lb. copper after byproduct credits.

With an initial capex of US$382 million (up from US$350 million in the 2018 study), the open pit project is forecast to produce an after-tax net present value of US$437 million and an internal rate of return of 29%, using a discount rate of 8%. Total capital investment is pegged at US$492 million.

“These results demonstrate the high quality nature of the Eva Copper Project,” said Gil Clausen, Copper Mountain’s president and CEO in a release. "Eva Copper has the potential to add significant production and cash flow to our existing solid operating base. While we are and will continue to add value to Eva Copper, it should be noted that we will only move forward with development in the right copper price environment. Eva provides Copper Mountain shareholders with high-quality organic growth potential in a low risk jurisdiction.”

Since the original feasibility study, Copper Mountain has added the Blackard and Scanlan deposits into its reserve count, increasing total reserves by 46%.

A total of seven deposits will be mined at Eva, producing an average of 100 million lb. copper and 13,650 oz. gold annually. Total ore mined is expected to be 170 million tonnes and total waste 380 million tonnes, for a waste to ore strip ratio of 2.2 to 1. Overall copper recoveries are estimated at 87%.

The process plant, which incorporates a larger ball mill than in the original study, and will feature a secondary crusher and high-pressure grinding roll (HPGR) design (instead of a SAG mill and pebble crushing circuit as originally planned), is designed to handle 31,200 t/d (11.4 million t/y). Mining from the various deposits will be sequenced to deliver a 3:1 ratio of sulphide copper ore to native copper ore. Copper and gold concentrate produced at Eva will be shipped to Glencore's Mt. Isa Smelter, 194 km southwest.

The study uses prices of US$2.97 per lb. copper and US$1,466 per oz. gold in year one, and longer term prices of US$3.04 per lb. copper and US$1,362 per oz. gold. An Australian dollar to U.S. dollar rate of 1.55:1 is used.

Eva hosts proven and probable reserves of 171 million tonnes grading 0.46% copper and 0.05 g/t gold for 1.7 billion lb. copper and 260,000 oz. gold.

Copper Mountain also has a 75% interest in the producing Copper Mountain mine in British Columbia, where operations have continued at reduced mining rates during the COVID-19 pandemic. Mitsubishi Materials Corp. holds the remaining 25% stake.

For more information, visit

Comments