PERU – Vancouver-based

Tinka Resources has intersected several zones of high grade zinc mineralization in the final hole of this year’s drill program at its 100% owned Ayawilca zinc project, 200 km northeast of Lima in the Pasco region.

Drill hole A19-168, an infill hole at South Ayawilca, returned an intercept of one metre grading 46.5% zinc from 125 metres, 26 metres grading 10.1% zinc from 162 metres and 4 metres grading 42.4% zinc from 297 metres within a wider interval of 51 metres grading 8% zinc from 251 metres.

Graham Carman, Tinka’s president and CEO, said in a statement that the mineralization encountered in A19-168 confirms high grade zinc in several sub-parallel, shallow-dipping mantos associated with massive to semi-massive sulphides hosted by Pucara limestone.

Previous assay results for three holes released in October also returned exceptional intercepts that expanded the Silver zone discovery.

Hole A19-165 returned some of the best zinc intersections ever drilled at South Ayawilca, intercepting four separate, gently dipping mineralized zones with downhole thicknesses of between 9 and 29 metres grading between 11.8% and 14% zinc within a cumulative downhole interval of 170 metres.

Hole A19-167 also intersected high grade silver mineralization accompanied by base metals over a narrow 1.7 metres grading 14.5% zinc and 0.3% lead, within a wider interval of 7.3 metres grading 4.9% zinc and 0.5% lead, from 412 metres.

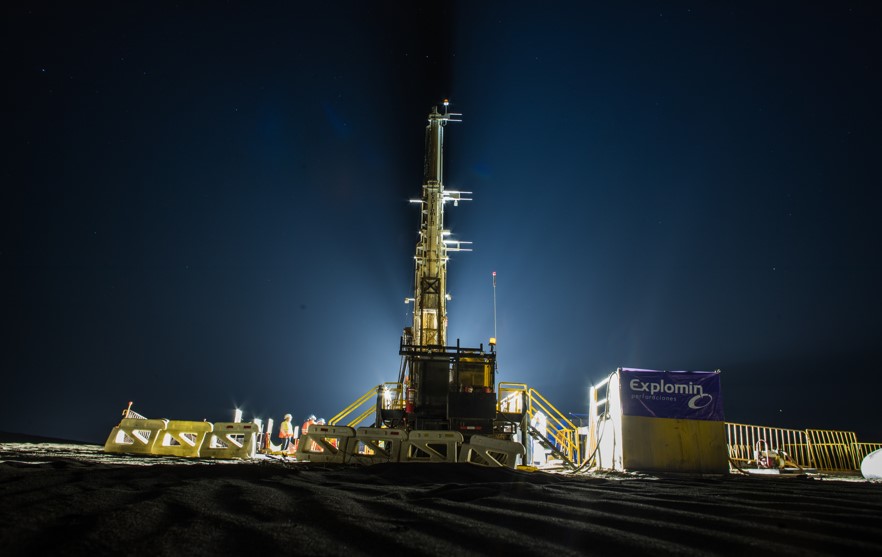

With the completion of the final infill hole, Tinka has concluded its 2019 drill program of 4,325 metres and will recommence drilling early next year.

The Peruvian Ministry of Energy and Mines has issued a drill permit for work programs next year, allowing the company to conduct drilling activities involving up to 240 drill platforms within the project’s existing permitted work area covering some 300 hectares.

A district-wide exploration program to review other significant mineral occurrences at the project has begun. A field team is mapping and carrying out soil sampling of several exploration targets located within 1 to 5 km of the Ayawilca zinc resource.

Since acquiring its land position at Ayawilca in 2005, Tinka’s mining concessions constitute more than 150 sq. km in the Central Peruvian Polymetallic Belt.

In July, the company completed a preliminary economic assessment of the zinc sulphide. The early stage study envisioned a 5,000-tonne-per-day, ramp access underground operation and average annual output of 101,000 tonnes zinc in concentrate, and 906,000 oz. silver in silver-lead concentrate.

Initial capex is pegged at US$262 million (including US$45 million for contingencies), and sustaining capex over the planned 21-year mine life is an estimated US$144 million.

The study forecast an after-tax net present value at an 8% discount rate of US$363 million, and internal rate of return of 27.1% and a 3.1 year payback at base case metal prices of US$1.20 per lb. zinc, US$18 per oz. silver and US95¢ per lb. lead. In addition, indium grades could constitute a payable by-product credit in the zinc concentrate.

The Ayawilca zinc zone has an indicated resource of 11.7 million tonnes at 6.9% zinc, 0.16% lead, 84 g/t indium and 15 g/t silver per tonne containing 1.8 billion lb. zinc, 42 million lb. lead, 983 tonnes indium and 5.8 million oz. silver. The deposit also has an inferred mineral resource of 45 million tonnes at 5.6% zinc, 0.23% lead, 67 g/t indium, and 17 g/t silver per tonne containing 5.6 billion lb. zinc, 230 million lb. lead, 3,003 tonnes indium and 25 million oz. silver.

Outside of its zinc deposit, Tinka has also outlined a tin mineralization zone at the project. The Ayawilca tin zone has inferred resources of 14.5 million tonnes at 0.63% tin, 0.21% copper and 18 g/t silver for 201 million contained lb. tin, 67 million lb. copper and 8 million oz. silver.

The company’s shareholders include Sentient Equity Partners (24%), International Finance Corporation-World Bank (11%) and JPMorgan UK (7 %).

At press time, Tinka shares were trading at 12¢ apiece within a 52-week range of 12¢ to 40¢. The company has 265 million shares outstanding for a $32-million market capitalization.

This story originally appeared on www.NorthernMiner.com.

Comments