[caption id="attachment_1003731971" align="aligncenter" width="403"]

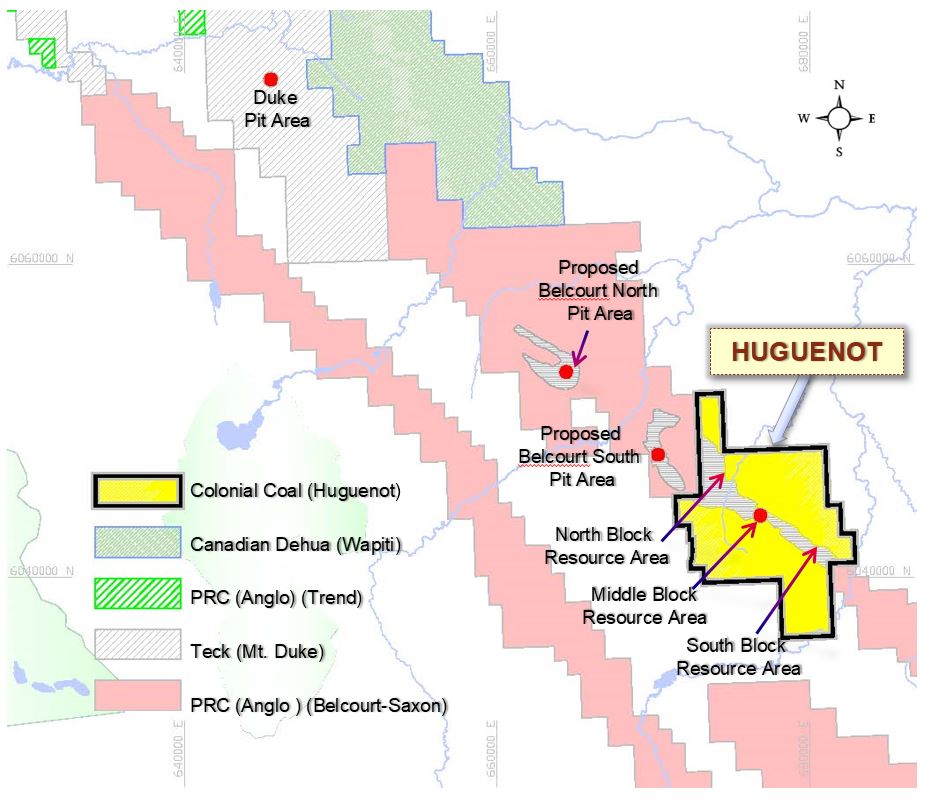

Location of the Huguenot coking coal project in northeastern B.C. (Image: Colonial Coal International)

Location of the Huguenot coking coal project in northeastern B.C. (Image: Colonial Coal International)[/caption]

BRITISH COLUMBIA – Vancouver’s

Colonial Coal International has released the results of the preliminary economic assessment for the Huguenot open pit coking coal mine. The property is located about 140 km by road from the Quintette loadout in the Peace River coal block.

The new PEA expands on the one prepared in 2013 and updates the one done in 2018. The earlier reports included a combined pit and underground operation. Prepared by

Stantec Consulting Services, the new PEA does not include a potential underground mining scenario.

Two capital expenditure options – for owning or leasing mining equipment – were examined. Pre-production capex for the ownership option is US$510 million, plus sustaining costs of US$215 million. If equipment were to be leased, the capex drops to US$303 million with sustaining costs of US$42 million over the life of the mine. Either way, the project has an internal rate of return of 15% at a coal price of US$137 per tonne.

Measured and indicated pit resources total 132.0 million tonnes, with an additional inferred resource of 500,000 tonnes. The inferred resource is included in the PEA.

Over a mine with a 27-year life, 99 million run-of-mine tonnes would be moved to produce 72 million tonnes of clean coal. Annual production would be between 700,000 tonnes and 3.0 million tonnes.

The company’s corporate presentation in PDF is available at

www.CCoal.ca, should CMJ readers wish to give their Chinese language skills a workout. The Power Point version is in English.

Location of the Huguenot coking coal project in northeastern B.C. (Image: Colonial Coal International)[/caption]

BRITISH COLUMBIA – Vancouver’s Colonial Coal International has released the results of the preliminary economic assessment for the Huguenot open pit coking coal mine. The property is located about 140 km by road from the Quintette loadout in the Peace River coal block.

The new PEA expands on the one prepared in 2013 and updates the one done in 2018. The earlier reports included a combined pit and underground operation. Prepared by Stantec Consulting Services, the new PEA does not include a potential underground mining scenario.

Two capital expenditure options – for owning or leasing mining equipment – were examined. Pre-production capex for the ownership option is US$510 million, plus sustaining costs of US$215 million. If equipment were to be leased, the capex drops to US$303 million with sustaining costs of US$42 million over the life of the mine. Either way, the project has an internal rate of return of 15% at a coal price of US$137 per tonne.

Measured and indicated pit resources total 132.0 million tonnes, with an additional inferred resource of 500,000 tonnes. The inferred resource is included in the PEA.

Over a mine with a 27-year life, 99 million run-of-mine tonnes would be moved to produce 72 million tonnes of clean coal. Annual production would be between 700,000 tonnes and 3.0 million tonnes.

The company’s corporate presentation in PDF is available at

Location of the Huguenot coking coal project in northeastern B.C. (Image: Colonial Coal International)[/caption]

BRITISH COLUMBIA – Vancouver’s Colonial Coal International has released the results of the preliminary economic assessment for the Huguenot open pit coking coal mine. The property is located about 140 km by road from the Quintette loadout in the Peace River coal block.

The new PEA expands on the one prepared in 2013 and updates the one done in 2018. The earlier reports included a combined pit and underground operation. Prepared by Stantec Consulting Services, the new PEA does not include a potential underground mining scenario.

Two capital expenditure options – for owning or leasing mining equipment – were examined. Pre-production capex for the ownership option is US$510 million, plus sustaining costs of US$215 million. If equipment were to be leased, the capex drops to US$303 million with sustaining costs of US$42 million over the life of the mine. Either way, the project has an internal rate of return of 15% at a coal price of US$137 per tonne.

Measured and indicated pit resources total 132.0 million tonnes, with an additional inferred resource of 500,000 tonnes. The inferred resource is included in the PEA.

Over a mine with a 27-year life, 99 million run-of-mine tonnes would be moved to produce 72 million tonnes of clean coal. Annual production would be between 700,000 tonnes and 3.0 million tonnes.

The company’s corporate presentation in PDF is available at

Comments