Golden hopes for new mines

The Milky Way above the Springpole exploration camp.

CREDIT: FIRST MINING GOLD

There are hundreds of advanced exploration stage projects that count gold among their targets across Canada. Not all of them are being explored for their gold potential, but those juniors who are focusing on gold have been able to raise funds and move forward.

There is an old saying that if you want to see an elephant, go where the elephants are. The same is true of gold mining. If you want to find gold, go where the gold mines are.

Here are a few of the places companies are looking.

Skeena Resources’ Snip property, in B.C.

CREDIT: SKEENA RESOURCES

SKEENA RESOURCES

Snip

Barrick Gold built and operated the Snip mine, in B.C.’s Golden Triangle, from 1991 to 1999. During that time about 1 million oz. of gold was produced.

Although the average grade was 27.5 g/t gold, the gold price wouldn’t break US$325 and by the end of 1999 was down to US$290 per oz. The costs of running a stand-alone mine and mill were high.

Skeena optioned and then earned 100% of the past-producing mine in July 2017. The company quickly began to re-explore the property. With the gold price last year hitting US$1,200 to US$1,300 per oz., the project was a great deal more interesting The mine has seen approximately 8,500 metres of underground development, and 280,000 metres of historic drilling. An 11,000-metre phase two underground and surface drill program is currently under way. The assays are very high – 9.14 g/t over 10.2 metres,16.02 g/t over 12.3 metres, 36.65 g/t over 2 metres.

Besides high grades, the Snip property now enjoys access via a paved highway from Smithers, grid power within 17 km, and access to new year-round ocean port facilities in Stewart, B.C. None of this infrastructure was available when the mine was operated in the 1990s.

Snip looks to be lining up as a winner for Skeena. The company also has in its portfolio the former Eskay Creek gold mine, which produced 3.3 million oz. of gold and 160 million oz. of silver from 1994 to 2008. Grades there were 45 g/t gold and 2,224 g/t silver. Look for a maiden 43-101 resource estimate later this year.

The core shack at First Mining’s Springpole project. CREDIT: FIRST MINING GOLD

FIRST MINING GOLD

Springpole

First Mining acquired the Springpole property – one of Canada’s largest undeveloped gold projects – when it acquired Gold Canyon Resources in November 2015. The deposit lies about 110 km northeast of Red Lake, Ont., roughly halfway to the historic Pickle Crow gold mine.

First Mining is very confident about Springpole. It is engaged in consultation with local Indigenous peoples and other stakeholders, and it plans to complete the federal and provincial environmental process by the end of 2020. And if everything goes according to plan, the initial gold pour at Springpole could occur in 2024.

There are good reasons to be optimistic. The preliminary economic analysis prepared in 2017 proposes a large open pit mine and 36,000-t/d processing facility. At full production the mine would have an average annual output of 296,000 oz. of gold and 1.6 million oz. of silver. The all-in cash cost would be US$806 per oz. of gold equivalent.

The PEA outlines a 12-year mine life with a post-tax net present value (5% discount) of US$792 million and an internal rate of return 26.2%. The initial capital costs are pegged at US$586 million, and the payback period would be 3.5 years.

Resources: The Springpole deposit contains 139.1 million indicated tonnes grading 1.04 g/t gold and 5.4 g/t silver. The indicated resource contains 4.7 million oz. of gold and 24.2 million oz. of silver. The inferred resource is 11.4 million tonnes at 0.63 g/t gold and 3.1 g/t silver, containing 230,000 oz. of gold and 1.1 million oz. of silver.

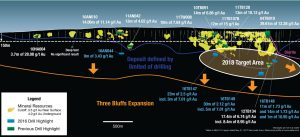

2018 drilling targets to expand the Three Bluffs

deposit at Committee Bay. CREDIT: AURYN RESOURCES

AURYN RESOURCES

Committee Bay

Auryn Resources acquired 100% of the Committee Bay project in September 2015. It lies in the Committee Bay Greenstone Belt about 180 km northeast of Agnico Eagle’s Meadowbank mine in Nunavut. The project benefits from existing infrastructure, a 100-person camp at the Three Bluffs deposit, and a pair of satellite camps in the southwest part of the belt.

There are a number of high quality exploration targets within the greenstone belt. Auryn has selected several of them for drilling this year, with drilling beginning in July. Of particular interest is the expansion of the Three Bluffs deposit, where 4,000 metres of drilling should expand the resource to depth and along strike.

The company has raised roughly $15 million so far this year. Much of it is earmarked for Committee Bay and the Gibson MacQuoid projects in Nunavut and Homestake Ridge in British Columbia’s Golden Triangle. Auryn is also working two gold projects in Peru.

Resources: The only estimate from Committee Bay covers the Three Bluffs deposit. The indicated portion includes 1.8 million near surface tonnes averaging 7.72 g/t gold for 437,000 oz., and 310,000 underground tonnes at 8.57 g/t gold for 86,000 oz. Inferred resources total 590,000 near surface tonnes at 7.57 g/t containing 144,000 oz. of gold plus 2.9 million underground tonnes at 7.65 g/t containing 576,000 oz. of gold.

For readers who are keeping track, that is 524,000 oz. contained in the indicated material and 720,000 oz. in the inferred material.

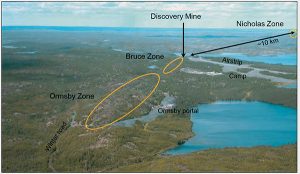

GoldMining’s Yellowknife gold project.

CREDIT: GOLDMINING

GOLDMINING

Yellowknife

GoldMining says its Yellowknife gold project is comprised of several properties spread out from 17 to 100 km north of the town of Yellowknife, in the Northwest Territories. They include Nicholas Lake, Ormsby, Goodwin Lake, Clan Lake and Big Sky. The Ormsby property is home of the Discovery mine that operated 1950 to 1969, producing an estimated 1 million oz. of gold from ore grading 28 g/t.

GoldMining is reviewing the existing database of information from the Yellowknife Greenstone Belt and a 43-101 resource estimate is under way. Meanwhile, the company acquired additional gold claims this year – the Narrow Lake property – that is contiguous Nicholas Lake and Ormsby properties.

The Yellowknife Greenstone Belt is certainly worthy of additional exploration. The historic mines – Giant and Com to the south and Discovery to the north –together produced about 15 million oz. of gold.

Historic resource: The following is not 43-101 compliant, but may be interesting. Measured and indicated resources at 27.1 million tonnes grading 1.97 g/t gold (1.7 million oz.) at a 0.5 g/t cut-off for open pit and 1.5 g/t for underground material. The inferred portion is 5.8 million tonnes grading 2.62 g/t gold (487,000 oz.) using the same cut-off criteria.

Pure Gold is rehabilitating the ramp at the Madsen project. CREDIT: PURE GOLD MINING

PURE GOLD MINING

Madsen

Madsen is a former gold producer with 2.4 million oz. of gold to its credit. It operated between 1938 and 1976. The property has been explored by Claude Resources and Placer Dome in the 1990s. Claude produced a maiden 43-101 resource estimate in 2013 and Pure Gold purchased the property in 2014 with the goal of consolidating the Madsen Mine Trend and expanding resources.

Pure Gold updated the PEA for the project, 16 km west of Red Lake, Ont., in 2018. This company, unlike most of the juniors mentioned here, is solely focused on one project, advancing it as quickly as funding will allow.

The project is fully permitted, allowing the operation of a 1,000-t/d mill and carbon-in-pulp circuit. There is a 1,275- metre deep shaft and headframe at the site, a portal and ramp, as well as 27 levels of underground workings.

The PEA suggests that the pre-production capex requirement will be only $51 million. The after-tax NPV (5%) is $258 million and the after-tax IRR will be 47%. Payback will be achieved after 2.8 years.

An updated resource estimate is expected later this year, and a definitive feasibility study is underway.

Resources: The Madsen deposit has indicated resources of 5.8 million tonnes grading 8.9 g/t gold and containing 1.7 million oz. The inferred portion contains 587,000 tonnes at 9.4 g/t for 300,000 oz. of gold.

A potential expansion could include mining the small Russet South and Fork deposits.

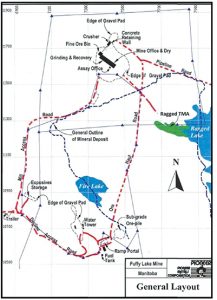

General layout of the PL project site. CREDIT: MINNOVA CORP.

MINNOVA CORP.

PL

Since acquiring the PL high grade, former gold producer in 2011, Minnova Corp. has been steadily advancing the mine toward reopening. The 2018 feasibility study recommends a $34.3 million pre-production capex. This includes reopening the underground mine and establishing several small open pits.

The property has a maintenance shop, backfill plant, explosives magazines, laydown yard, mine rescue station, water storage pond, power substation, compressor system, and 1,000 t/d mill.

To put the old mine back into production, the company will have to dewater the old workings, rehabilitate the existing ramp, stabilize the old stopes as required, rehab part of the 1109 level, and embark on additional lateral development. The mining method will probably be up-dip stoping.

The mill will be placed back in service with conventional crushing and grinding, a gravity circuit, flotation, regrinding, and cyanidation followed by Merrill-Crowe recovery. The gold will be refined into doré bars on site. The existing tailings management facility will be recommissioned.

Resources: Measured and indicated resources at 1.5 million tonnes grading 5.29 g/t gold and containing 282,500 oz at a cutoff of 2.5 g/t. The inferred portion is another 1.8 million tonnes at 5.08 g/t and containing 301,700 oz. of gold.

The White Gold project in the Yukon. CREDIT: WHITE GOLD

WHITE GOLD CORP.

White Gold

If a junior can’t find a historic mine to explore, another good strategy is to purchase a property that a larger company is holding but not active at. White Gold did that when it purchased the White Gold, Black Fox, JP Ross, Yellow, and Battle properties from Kinross Gold in June 2017. The White Gold property with its Golden Saddle and Arc deposits is about 95 km south of Dawson City, Yukon.

The property has helicopter, airstrip and barge access with a 100-person camp at Thistle Creek. Access will improve under the federal government’s Yukon Resource Gateway project. The project will upgrade 650 km of roads in four separate public areas in the White Gold District. Numerous bridges, culverts and stream crossings will also be updated.

White Gold says that where resources are known, the mineralization shows vertical continuity and remains largely open at depth and along strike.

Last year White gold identified a new high priority target adjacent to the Golden Saddle deposit. The target is located on strike and 600 metres to the northeast of the Golden Saddle deposit. Two diamond drills and a reverse circulation drill are on site testing the target this year.

Resources: The White Gold project has indicated resources of 12.3 million tonnes at 2.43 g/t gold and an inferred resource of 5.2 million tonnes at 1.70 g/t gold in the Golden Saddle (Main, Footwall and Upper zones) and the Arc deposits.

Comments