[caption id="attachment_1003722828" align="aligncenter" width="479"]

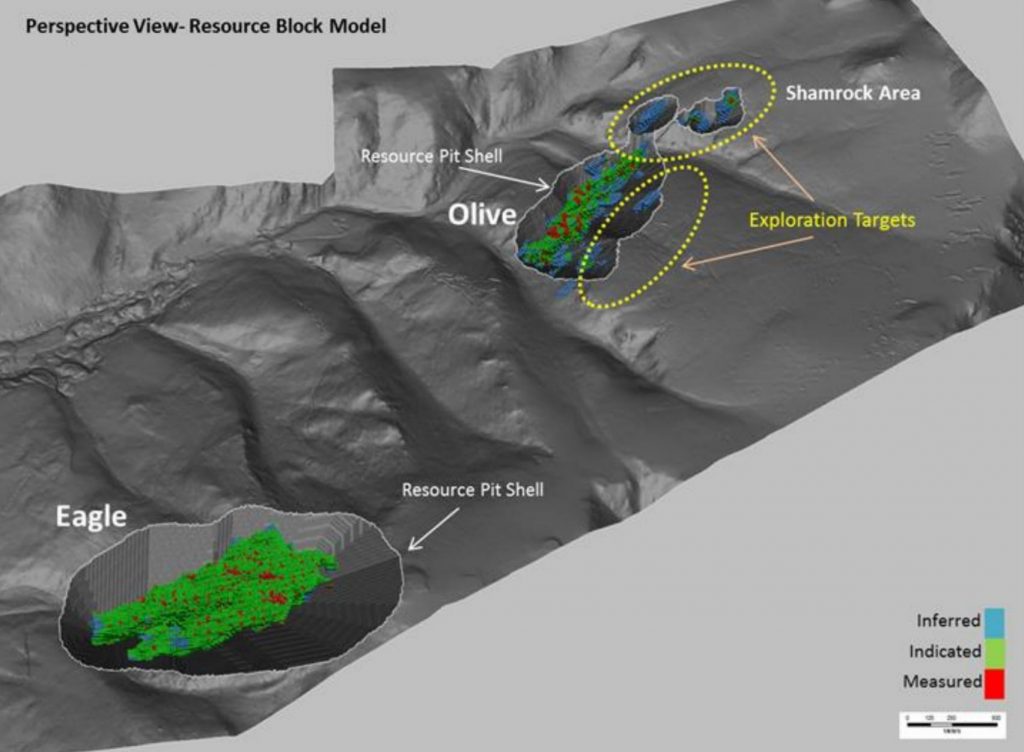

Perspective view of the Eagle gold mine resource block model. (Image: Victoria Gold)

Perspective view of the Eagle gold mine resource block model. (Image: Victoria Gold)[/caption]

YUKON –

Orion Mine Finance of Toronto has invested $75 million in

Victoria Gold and its shovel ready Eagle gold project about 85 km northeast of the village of Mayo in the central part of the territory. Orion has purchased 150 million new Victoria shares at a price of $0.50 per share.

Orion’s investment is part of the $295 million financing package provided by Orion and its affiliates. Orion has also offered a $94.5 million senior secured credit facility and a $126.0 million subordinated secured credit facility. Orion also received warrants to purchase 25 million additional common shares at a price of $0.625 each until April 13, 2023.

Orion also entered into a cash-settled European gold call option certificate with Victoria with respect to options on 20,000 oz. of refined gold at a price of US$1,485 per oz., settled on April 13, 2023. Orion Co-VI also entered into a gold offtake agreement with Victoria that will entitle Orion Co-VI to buy 25% of the Eagle mine gold production.

Orion now holds a 19.55% interest in Victoria on a non-diluted basis. After exercise of the warrants, Orion would hold a 19.99% interest on a diluted basis.

Osisko Gold Royalties has also invested $98 million in Victoria for a 5% net smelter return royalty and 100 million Victoria common shares.

The Eagle gold project is part of Victoria’s larger Dublin Gulch property. The property also hosts the Wolf tungsten deposit, and a 13-km-long belt of gold and silver mineralization known as the Potato Hills Trend.

Read about Victoria’s $396-million plans for development of the Eagle mine at

www.VitGoldCorp.com.

Perspective view of the Eagle gold mine resource block model. (Image: Victoria Gold)[/caption]

YUKON – Orion Mine Finance of Toronto has invested $75 million in Victoria Gold and its shovel ready Eagle gold project about 85 km northeast of the village of Mayo in the central part of the territory. Orion has purchased 150 million new Victoria shares at a price of $0.50 per share.

Orion’s investment is part of the $295 million financing package provided by Orion and its affiliates. Orion has also offered a $94.5 million senior secured credit facility and a $126.0 million subordinated secured credit facility. Orion also received warrants to purchase 25 million additional common shares at a price of $0.625 each until April 13, 2023.

Orion also entered into a cash-settled European gold call option certificate with Victoria with respect to options on 20,000 oz. of refined gold at a price of US$1,485 per oz., settled on April 13, 2023. Orion Co-VI also entered into a gold offtake agreement with Victoria that will entitle Orion Co-VI to buy 25% of the Eagle mine gold production.

Orion now holds a 19.55% interest in Victoria on a non-diluted basis. After exercise of the warrants, Orion would hold a 19.99% interest on a diluted basis.

Osisko Gold Royalties has also invested $98 million in Victoria for a 5% net smelter return royalty and 100 million Victoria common shares.

The Eagle gold project is part of Victoria’s larger Dublin Gulch property. The property also hosts the Wolf tungsten deposit, and a 13-km-long belt of gold and silver mineralization known as the Potato Hills Trend.

Read about Victoria’s $396-million plans for development of the Eagle mine at

Perspective view of the Eagle gold mine resource block model. (Image: Victoria Gold)[/caption]

YUKON – Orion Mine Finance of Toronto has invested $75 million in Victoria Gold and its shovel ready Eagle gold project about 85 km northeast of the village of Mayo in the central part of the territory. Orion has purchased 150 million new Victoria shares at a price of $0.50 per share.

Orion’s investment is part of the $295 million financing package provided by Orion and its affiliates. Orion has also offered a $94.5 million senior secured credit facility and a $126.0 million subordinated secured credit facility. Orion also received warrants to purchase 25 million additional common shares at a price of $0.625 each until April 13, 2023.

Orion also entered into a cash-settled European gold call option certificate with Victoria with respect to options on 20,000 oz. of refined gold at a price of US$1,485 per oz., settled on April 13, 2023. Orion Co-VI also entered into a gold offtake agreement with Victoria that will entitle Orion Co-VI to buy 25% of the Eagle mine gold production.

Orion now holds a 19.55% interest in Victoria on a non-diluted basis. After exercise of the warrants, Orion would hold a 19.99% interest on a diluted basis.

Osisko Gold Royalties has also invested $98 million in Victoria for a 5% net smelter return royalty and 100 million Victoria common shares.

The Eagle gold project is part of Victoria’s larger Dublin Gulch property. The property also hosts the Wolf tungsten deposit, and a 13-km-long belt of gold and silver mineralization known as the Potato Hills Trend.

Read about Victoria’s $396-million plans for development of the Eagle mine at

Comments