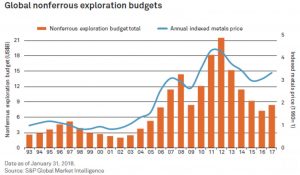

[caption id="attachment_1003722263" align="aligncenter" width="488"]

Global non-ferrous exploration budgets. (Image: S&P Global Market Intelligence)

Global non-ferrous exploration budgets. (Image: S&P Global Market Intelligence)[/caption]

NEW YORK CITY –

S&P Global Market Intelligence predicts that exploration spending will continue to grow this year – by as much as 15% to 20%. This follows a 15% jump to US$8.4 billion in 2017, compared to US$7.3 in 2016.

Investors are backing juniors at a level not seen since 2013. Gold was the main focus of exploration, but base metals activity heated up in the last half of the year. Battery metals also attracted attention as the price of cobalt, for example, doubled last year.

S&P found that Canada, Australia and the United States were the leaders in exploration spending with commitments reaching US$5.55 billion. Difficulty in accessing funds early in the year meant that the number of juniors with spending plans declined 3% to 1,535 companies. S&P’s Pipeline Activity Index also rebounded to 87 in the fourth quarter from 77 in the third quarter, the highest it had been since the first quarter of 2013.

To download the full

World Exploration Trends (WET) report at no charge from S&P Global Market Intelligence, click

here.

Global non-ferrous exploration budgets. (Image: S&P Global Market Intelligence)[/caption]

NEW YORK CITY – S&P Global Market Intelligence predicts that exploration spending will continue to grow this year – by as much as 15% to 20%. This follows a 15% jump to US$8.4 billion in 2017, compared to US$7.3 in 2016.

Investors are backing juniors at a level not seen since 2013. Gold was the main focus of exploration, but base metals activity heated up in the last half of the year. Battery metals also attracted attention as the price of cobalt, for example, doubled last year.

S&P found that Canada, Australia and the United States were the leaders in exploration spending with commitments reaching US$5.55 billion. Difficulty in accessing funds early in the year meant that the number of juniors with spending plans declined 3% to 1,535 companies. S&P’s Pipeline Activity Index also rebounded to 87 in the fourth quarter from 77 in the third quarter, the highest it had been since the first quarter of 2013.

To download the full World Exploration Trends (WET) report at no charge from S&P Global Market Intelligence, click

Global non-ferrous exploration budgets. (Image: S&P Global Market Intelligence)[/caption]

NEW YORK CITY – S&P Global Market Intelligence predicts that exploration spending will continue to grow this year – by as much as 15% to 20%. This follows a 15% jump to US$8.4 billion in 2017, compared to US$7.3 in 2016.

Investors are backing juniors at a level not seen since 2013. Gold was the main focus of exploration, but base metals activity heated up in the last half of the year. Battery metals also attracted attention as the price of cobalt, for example, doubled last year.

S&P found that Canada, Australia and the United States were the leaders in exploration spending with commitments reaching US$5.55 billion. Difficulty in accessing funds early in the year meant that the number of juniors with spending plans declined 3% to 1,535 companies. S&P’s Pipeline Activity Index also rebounded to 87 in the fourth quarter from 77 in the third quarter, the highest it had been since the first quarter of 2013.

To download the full World Exploration Trends (WET) report at no charge from S&P Global Market Intelligence, click

Comments