[caption id="attachment_1003722175" align="aligncenter" width="449"]

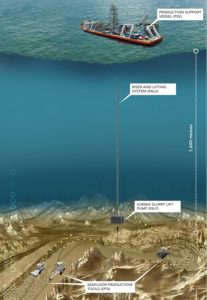

The technology Nautilus will employ to mine the sea bed in Papua New Guinea. (Image: Nautilus Minerals)

The technology Nautilus will employ to mine the sea bed in Papua New Guinea. (Image: Nautilus Minerals)[/caption]

PAPUA NEW GUINEA – Toronto-based

Nautilus Minerals has completed the preliminary economic assessment for its Solwara 1 seabed copper-gold project in the Bismarck Sea.

Nautilus has been inching the Solwara 1 project forward for almost 40 years. The project has been dogged by the reinvention of technology, lack of funding, the ups and downs of mining industry cycles, and squabbling with partners.

According to the PEA, Solwara 1 carries an undiscounted post-tax net cash flow of $179 million (all U.S. dollar amounts) and a discounted (15%) net cash flow of $56 million per year. The internal rate of return for the base case is 28%, but it rises to 40% using average forward curve metal prices for copper and gold.

Solwara is fully permitted, and the PNG government has a 15% interest. Nautilus still needs to raise $243 million to meet capex requirements prior to beginning production. Ramping up to steady state rates of 3,200 t/d would take a further 15 months. Thereafter, the project could produce 20,000 tonnes of copper and 29,000 oz. of gold per quarter.

Mining the sea bed will require seafloor production tools, a riser and lifting system to bring the material to the surface, plus a production support vessel. Learn how these will operate at

www.NautilusMinerals.com.

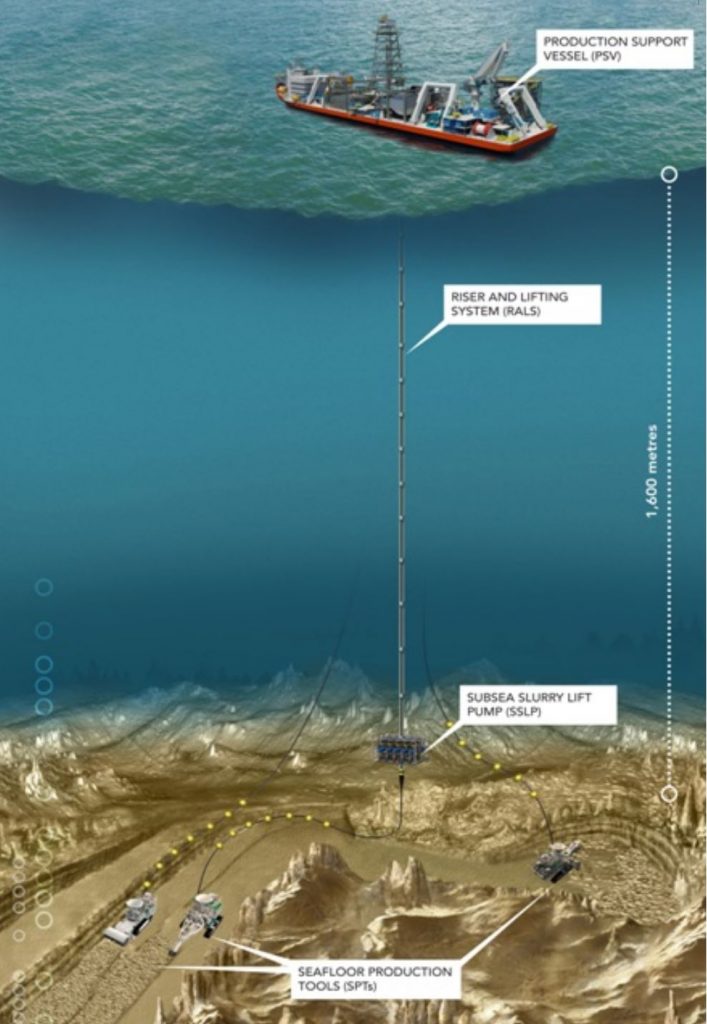

The technology Nautilus will employ to mine the sea bed in Papua New Guinea. (Image: Nautilus Minerals)[/caption]

PAPUA NEW GUINEA – Toronto-based Nautilus Minerals has completed the preliminary economic assessment for its Solwara 1 seabed copper-gold project in the Bismarck Sea.

Nautilus has been inching the Solwara 1 project forward for almost 40 years. The project has been dogged by the reinvention of technology, lack of funding, the ups and downs of mining industry cycles, and squabbling with partners.

According to the PEA, Solwara 1 carries an undiscounted post-tax net cash flow of $179 million (all U.S. dollar amounts) and a discounted (15%) net cash flow of $56 million per year. The internal rate of return for the base case is 28%, but it rises to 40% using average forward curve metal prices for copper and gold.

Solwara is fully permitted, and the PNG government has a 15% interest. Nautilus still needs to raise $243 million to meet capex requirements prior to beginning production. Ramping up to steady state rates of 3,200 t/d would take a further 15 months. Thereafter, the project could produce 20,000 tonnes of copper and 29,000 oz. of gold per quarter.

Mining the sea bed will require seafloor production tools, a riser and lifting system to bring the material to the surface, plus a production support vessel. Learn how these will operate at

The technology Nautilus will employ to mine the sea bed in Papua New Guinea. (Image: Nautilus Minerals)[/caption]

PAPUA NEW GUINEA – Toronto-based Nautilus Minerals has completed the preliminary economic assessment for its Solwara 1 seabed copper-gold project in the Bismarck Sea.

Nautilus has been inching the Solwara 1 project forward for almost 40 years. The project has been dogged by the reinvention of technology, lack of funding, the ups and downs of mining industry cycles, and squabbling with partners.

According to the PEA, Solwara 1 carries an undiscounted post-tax net cash flow of $179 million (all U.S. dollar amounts) and a discounted (15%) net cash flow of $56 million per year. The internal rate of return for the base case is 28%, but it rises to 40% using average forward curve metal prices for copper and gold.

Solwara is fully permitted, and the PNG government has a 15% interest. Nautilus still needs to raise $243 million to meet capex requirements prior to beginning production. Ramping up to steady state rates of 3,200 t/d would take a further 15 months. Thereafter, the project could produce 20,000 tonnes of copper and 29,000 oz. of gold per quarter.

Mining the sea bed will require seafloor production tools, a riser and lifting system to bring the material to the surface, plus a production support vessel. Learn how these will operate at

Comments