[caption id="attachment_1003720675" align="aligncenter" width="544"]

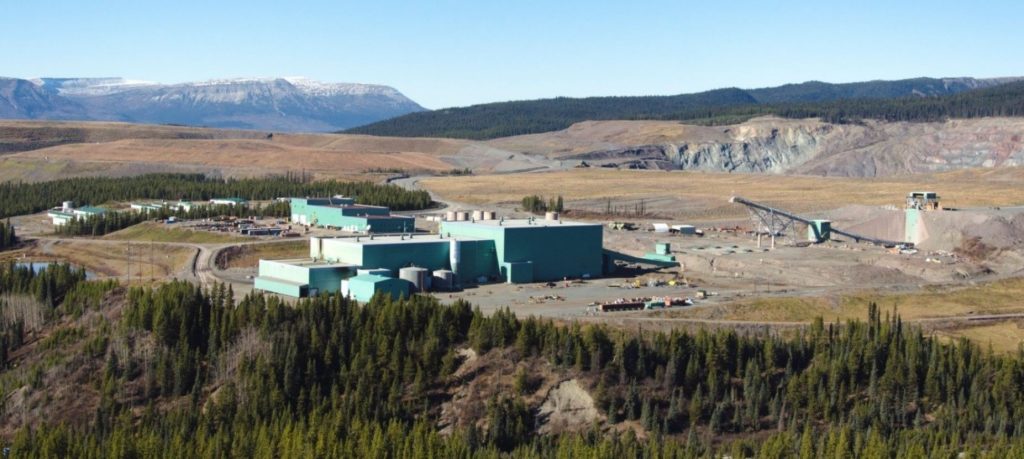

Infrastructure at the former Kemess open pit site is worth $1 billion in today’s dollars. (Image: AuRico Metals)

Infrastructure at the former Kemess open pit site is worth $1 billion in today’s dollars. (Image: AuRico Metals)[/caption]

TORONTO –

Centerra Gold and

AuRico Metals are planning a friendly amalgamation of their businesses. Centerra will acquire all of the issued and outstanding shares of AuRico for $1.80 per share, representing a transaction value of $310 million.

The price represents a 38% premium to the closing price of AuRico’s shares on Nov. 6, 2017, and a premium of 37% to the 20-day volume weighted average price as of that date. Centerra says it currently has about $450 million in cash to fund the takeover, and it has secured a new acquisition facility worth approximately $162 million.

Centerra is expanding its presence in Canada, beginning with the takeover of Thompson Creek Metals a year ago, giving it control over the Mt. Milligan copper-gold mine and the suspended Endako molybdenum mine in British Columbia. This deal gives it another property in western Canada.

AuRico’s major asset is the Kemess underground gold-copper mine development project in the Toodoggone River area of B. C. The project is only 6 km north of the former Kemess South open pit mine where existing infrastructure would cost more than $1 billion to replace at today’s costs. A feasibility study was recently completed, and AuRico has environmental approval for the project. An impact benefit agreement covering the new mine has been signed with the Takla Lake, Tasy Keh Dene and Kwadacha nations.

The Kemess underground mine has probable reserves of 107.4 million tonnes grading 0.54 g/t gold and 0.27% copper, containing 1.8 million oz. of gold and 629.6 million lb. of copper. There is also an indicated resource of 246.4 million tonnes at 0.42 g/t gold and 0.22% copper, plus an inferred resource of 21.6 million tonnes at 0.40 g/t gold and 0.22% copper.

Stephen A. Lang, chairman of Centerra, said, "With the acquisition of the AuRico Metals assets, Centerra expands its existing development pipeline to include another low cost, de-risked brownfield development asset, the Kemess property, located in Canada – one of the lowest risk mining jurisdictions in the world.”

Along with the Kemess property, Centerra will acquire AuRico’s royalty portfolio.

Details of the arrangement are available at both

www.CenterraGold.com and

www.AuRicoMetals.ca.

Infrastructure at the former Kemess open pit site is worth $1 billion in today’s dollars. (Image: AuRico Metals)[/caption]

TORONTO – Centerra Gold and AuRico Metals are planning a friendly amalgamation of their businesses. Centerra will acquire all of the issued and outstanding shares of AuRico for $1.80 per share, representing a transaction value of $310 million.

The price represents a 38% premium to the closing price of AuRico’s shares on Nov. 6, 2017, and a premium of 37% to the 20-day volume weighted average price as of that date. Centerra says it currently has about $450 million in cash to fund the takeover, and it has secured a new acquisition facility worth approximately $162 million.

Centerra is expanding its presence in Canada, beginning with the takeover of Thompson Creek Metals a year ago, giving it control over the Mt. Milligan copper-gold mine and the suspended Endako molybdenum mine in British Columbia. This deal gives it another property in western Canada.

AuRico’s major asset is the Kemess underground gold-copper mine development project in the Toodoggone River area of B. C. The project is only 6 km north of the former Kemess South open pit mine where existing infrastructure would cost more than $1 billion to replace at today’s costs. A feasibility study was recently completed, and AuRico has environmental approval for the project. An impact benefit agreement covering the new mine has been signed with the Takla Lake, Tasy Keh Dene and Kwadacha nations.

The Kemess underground mine has probable reserves of 107.4 million tonnes grading 0.54 g/t gold and 0.27% copper, containing 1.8 million oz. of gold and 629.6 million lb. of copper. There is also an indicated resource of 246.4 million tonnes at 0.42 g/t gold and 0.22% copper, plus an inferred resource of 21.6 million tonnes at 0.40 g/t gold and 0.22% copper.

Stephen A. Lang, chairman of Centerra, said, "With the acquisition of the AuRico Metals assets, Centerra expands its existing development pipeline to include another low cost, de-risked brownfield development asset, the Kemess property, located in Canada – one of the lowest risk mining jurisdictions in the world.”

Along with the Kemess property, Centerra will acquire AuRico’s royalty portfolio.

Details of the arrangement are available at both

Infrastructure at the former Kemess open pit site is worth $1 billion in today’s dollars. (Image: AuRico Metals)[/caption]

TORONTO – Centerra Gold and AuRico Metals are planning a friendly amalgamation of their businesses. Centerra will acquire all of the issued and outstanding shares of AuRico for $1.80 per share, representing a transaction value of $310 million.

The price represents a 38% premium to the closing price of AuRico’s shares on Nov. 6, 2017, and a premium of 37% to the 20-day volume weighted average price as of that date. Centerra says it currently has about $450 million in cash to fund the takeover, and it has secured a new acquisition facility worth approximately $162 million.

Centerra is expanding its presence in Canada, beginning with the takeover of Thompson Creek Metals a year ago, giving it control over the Mt. Milligan copper-gold mine and the suspended Endako molybdenum mine in British Columbia. This deal gives it another property in western Canada.

AuRico’s major asset is the Kemess underground gold-copper mine development project in the Toodoggone River area of B. C. The project is only 6 km north of the former Kemess South open pit mine where existing infrastructure would cost more than $1 billion to replace at today’s costs. A feasibility study was recently completed, and AuRico has environmental approval for the project. An impact benefit agreement covering the new mine has been signed with the Takla Lake, Tasy Keh Dene and Kwadacha nations.

The Kemess underground mine has probable reserves of 107.4 million tonnes grading 0.54 g/t gold and 0.27% copper, containing 1.8 million oz. of gold and 629.6 million lb. of copper. There is also an indicated resource of 246.4 million tonnes at 0.42 g/t gold and 0.22% copper, plus an inferred resource of 21.6 million tonnes at 0.40 g/t gold and 0.22% copper.

Stephen A. Lang, chairman of Centerra, said, "With the acquisition of the AuRico Metals assets, Centerra expands its existing development pipeline to include another low cost, de-risked brownfield development asset, the Kemess property, located in Canada – one of the lowest risk mining jurisdictions in the world.”

Along with the Kemess property, Centerra will acquire AuRico’s royalty portfolio.

Details of the arrangement are available at both

Comments