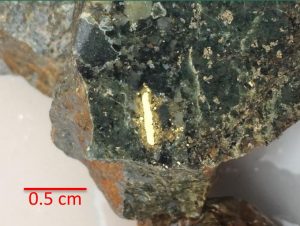

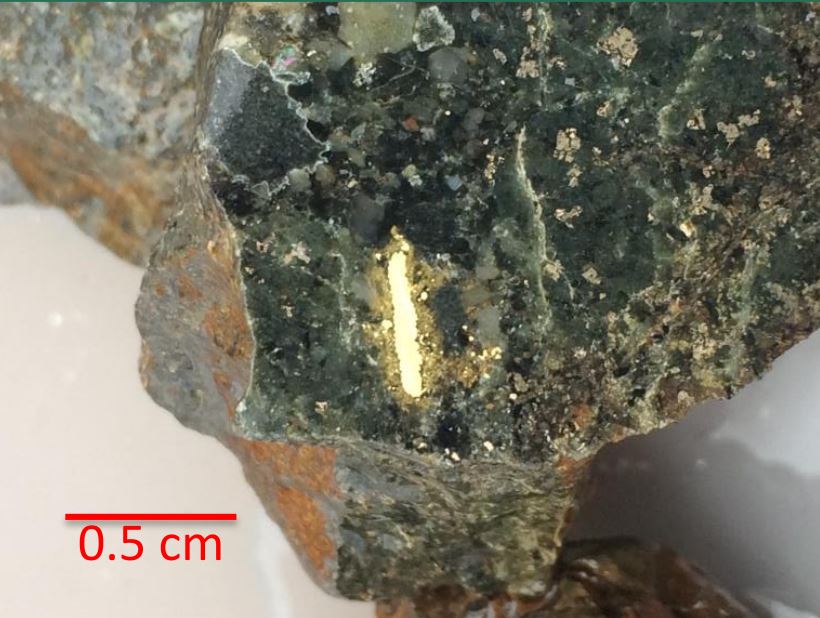

[caption id="attachment_1003719851" align="aligncenter" width="465"]

Visible gold from the Karratha gold project of Novo Resources. (Credit: Novo Resources)

Visible gold from the Karratha gold project of Novo Resources. (Credit: Novo Resources)[/caption]

VANCOUVER and TORONTO – Once again it seems investors are eager to put their money where the gold might be. In the last week,

Atlantic Gold placed $18.2 million in two separate deals,

Barkerville Gold Mines floated a $35-million deal, and

Kirkland Lake Gold announced its intention to funnel $56 million into

Novo Resources.

Let’s examine these deals individually.

Atlantic Gold said on Sept. 5 that it intends to raise $15 million by way of a bought deal private placement of flow-through and common shares, and a concurrent non-brokered private placement was to raise $3.2 million. The larger offering will be fulfilled in three tranches – 3.05 million flow-through shares at $1.80 each, 3.55 million common shares sold on a charitable flow-through basis at a price of $1.83 each, and 2.14 million common shares at $1.40 per share. Over-allotments of all three tranches have been offered. The non-brokered portion consists of 2.30 million common shares at a price of $1.40 each. (

www.AtlanticGoldCorporation.com)

On Sept. 1, Barkerville offered 25 million flow-through shares at a price of $1.12 per share for gross proceeds of $28 million. Later the same day, the company said that an additional 8.75 million common shares would be sold at a price of $0.80 each for gross proceeds of $7 million. Barkerville aims to develop a gold mine in the Cariboo Mining District of central British Columbia. (

www.BarkervilleGold.com)

Kirkland Lake Gold said on Sept. 5 that it is investing $56 million in Nova Resources. The investment will be carried out through the purchase of 14 million units issued by Nova at a price of $4.00 per unit. Each unit consists of one Nova common share and one share purchase warrant. Each warrant will allow KLGold to buy an additional Novo share at a price of $6.00 each over a period of 36 months. Novo Resources has a portfolio of gold properties, most of which are in Australia. (

www.KLGold.com or www.NovoResources.com)

Visible gold from the Karratha gold project of Novo Resources. (Credit: Novo Resources)[/caption]

VANCOUVER and TORONTO – Once again it seems investors are eager to put their money where the gold might be. In the last week, Atlantic Gold placed $18.2 million in two separate deals, Barkerville Gold Mines floated a $35-million deal, and Kirkland Lake Gold announced its intention to funnel $56 million into Novo Resources.

Let’s examine these deals individually.

Atlantic Gold said on Sept. 5 that it intends to raise $15 million by way of a bought deal private placement of flow-through and common shares, and a concurrent non-brokered private placement was to raise $3.2 million. The larger offering will be fulfilled in three tranches – 3.05 million flow-through shares at $1.80 each, 3.55 million common shares sold on a charitable flow-through basis at a price of $1.83 each, and 2.14 million common shares at $1.40 per share. Over-allotments of all three tranches have been offered. The non-brokered portion consists of 2.30 million common shares at a price of $1.40 each. (

Visible gold from the Karratha gold project of Novo Resources. (Credit: Novo Resources)[/caption]

VANCOUVER and TORONTO – Once again it seems investors are eager to put their money where the gold might be. In the last week, Atlantic Gold placed $18.2 million in two separate deals, Barkerville Gold Mines floated a $35-million deal, and Kirkland Lake Gold announced its intention to funnel $56 million into Novo Resources.

Let’s examine these deals individually.

Atlantic Gold said on Sept. 5 that it intends to raise $15 million by way of a bought deal private placement of flow-through and common shares, and a concurrent non-brokered private placement was to raise $3.2 million. The larger offering will be fulfilled in three tranches – 3.05 million flow-through shares at $1.80 each, 3.55 million common shares sold on a charitable flow-through basis at a price of $1.83 each, and 2.14 million common shares at $1.40 per share. Over-allotments of all three tranches have been offered. The non-brokered portion consists of 2.30 million common shares at a price of $1.40 each. (

Comments