TORONTO –

Centerra Gold has hedged part of its planned 2017 copper production from the Mount Milligan copper-gold operation 145 km northwest of Prince George. Slightly more than half of this year’s output is pledged to the arrangement.

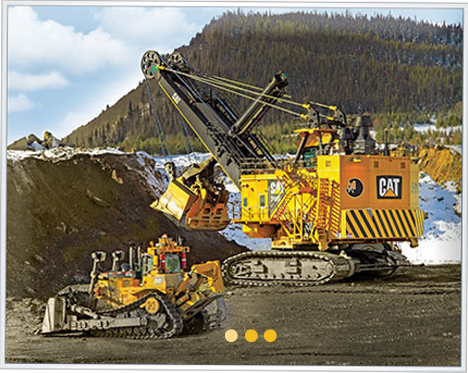

[caption id="attachment_1003716894" align="alignleft" width="300"]

Mount Milligan is an open pit copper and gold producer.

Mount Milligan is an open pit copper and gold producer.[/caption]

Centerra entered into fixed price forward sales contracts for 24.9 million lb the project’s expected 2017 copper production at an average price of US$2.69/lb. This represents approximately 51% of production, net of copper streaming arrangements with Royal Gold.

The company has also entered into zero-cost collars for 8.3 million lb of copper with settlements dates during February to December 2017 at a minimum price of US$2.25/lb and a maximum price of US$3.21/lb.

Centerra's current policy is not to hedge more than 75% of its copper production, net of copper streaming arrangements. The company says it has no plans to hedge any of the unstreamed gold production from Mount Milligan.

Learn more about the Mount Milligan project at

www.CenterraGold.com.

Mount Milligan is an open pit copper and gold producer.[/caption]

Centerra entered into fixed price forward sales contracts for 24.9 million lb the project’s expected 2017 copper production at an average price of US$2.69/lb. This represents approximately 51% of production, net of copper streaming arrangements with Royal Gold.

The company has also entered into zero-cost collars for 8.3 million lb of copper with settlements dates during February to December 2017 at a minimum price of US$2.25/lb and a maximum price of US$3.21/lb.

Centerra's current policy is not to hedge more than 75% of its copper production, net of copper streaming arrangements. The company says it has no plans to hedge any of the unstreamed gold production from Mount Milligan.

Learn more about the Mount Milligan project at

Mount Milligan is an open pit copper and gold producer.[/caption]

Centerra entered into fixed price forward sales contracts for 24.9 million lb the project’s expected 2017 copper production at an average price of US$2.69/lb. This represents approximately 51% of production, net of copper streaming arrangements with Royal Gold.

The company has also entered into zero-cost collars for 8.3 million lb of copper with settlements dates during February to December 2017 at a minimum price of US$2.25/lb and a maximum price of US$3.21/lb.

Centerra's current policy is not to hedge more than 75% of its copper production, net of copper streaming arrangements. The company says it has no plans to hedge any of the unstreamed gold production from Mount Milligan.

Learn more about the Mount Milligan project at

Comments