Hunting Diamonds in a Field of Elephants

Geologists often refer to exploration for large deposits as looking for elephants. Large deposits should be easier to find, they should have a long mine life because of their tonnage and they should be cheaper to mine due to economies of scale. The team running the Fort la Corne diamond project in central Saskatchewan has found that elephant, and is now having to decide the best way to speed up the evaluation process.

Joint venture partners De Beers Canada Exploration Inc. (42.245%), Kensington Resources Ltd. (42.245%), Cameco Corp. (5.510%) and UEM Inc. (carried 10%) hold title to one of the largest kimberlite fields in the world.

The joint venture lands cover over 22,000 ha. More than 70 kimberlites have been found in the Fort la Corne kimberlite field with about 63 of them on the joint venture property. The number of kimberlites is fluid because they were originally based on geophysical evidence, but as these targets are tested it turns out that many of the individual targets are part of the same kimberlite complex. Forty-seven of the kimberlites have surface areas greater than 25 ha each for a total of 2,300 ha (or almost nine square miles). By way of comparison, the Diavik A154S has a footprint of 2 ha and the Ekati Panda has a footprint of 3.1 ha. On the Fort la Corne joint venture, the 140/141 kimberlite has a footprint of 250 ha, the 120 kimberlite has a 102-ha footprint and the 122 kimberlite covers 108 ha.

Interest from the late 1980s

The story began in 1969 when the Geological Survey of Canada (GSC) carried out an aeromagnetic survey of the Prince Albert area in Saskatchewan. In 1988, German uranium explorer Uranerz Exploration and Mining Ltd. (UEM) staked 61,270 ha in the Fort la Corne area based on the results of the 1969 survey and diamond exploration in the Sturgeon Lake area.

The following year, with 50% joint-venture partner Saskatchewan Mining Development Corp. (SMDC) (predecessor to Cameco), UEM completed seven shallow rotary drill holes. Each hole intersected kimberlite, and core from five of the holes contained microdiamonds.

Exploration continued, with ground geophysical follow-up of aeromagnetic targets, drill-testing of geophysical targets, recovery of diamonds from the drilling and geophysical surveys to gauge the outline and thickness of the kimberlite bodies.

In 1992, De Beers joined the joint venture, followed by junior explorer Kensington Resources in 1995. By 1997, UEM elected to dilute down to a 10% free-carried interest until such time as a production decision is made.

The following year, Cameco acquired UEM, and De Beers took over from UEM as project operator.

By 2000, the program was trying to put a value on the higher potential kimberlite bodies, particularly 140/141. Work continued to evaluate the known bodies; higher interest units within the 140/141, 122 and 148 bodies were identified by 2003.

A total of 1,844 macrodiamonds (minimum size of 0.85 mm in one dimension) weighing 218.45 carats were recovered from 1989 to 2002. Of this total, 1,427 macrodiamonds with a cumulative weight of 159.51 carats have been recovered from kimberlite 140/141. Approximately 8,500 microdiamonds have been recovered from all kimberlites to mid-2004.

The joint venture is run by a management committee that consists of representatives from the joint-venture partners, such that all partners have equal input into planning. The management team, consisting of many new members, met in October to plan how to accelerate the project in order to meet the needs of the partners.

To reflect this accelerated process, the budget was increased to $7.62 million for the 2004-05 exploration program, a substantial increase considering that from 1989 to 2003 approximately $30 million was spent by the partners. The focus of the program is two-fold: first, to complete a mini-bulk sample on the 122 and 140/141 kimberlites to collect 80 to 100 carats of diamonds within specific zones of these bodies for grade estimates and revenue modelling; and secondly, to test the 120, 121/221 and 147 kimberlite bodies with mini-bulk sampling to collect 80 to 100 carats from these bodies.

This work will allow the geologists to establish the internal geological framework of the kimberlites, allowing a fuller understanding of the location of the richer parts of the kimberlites.

Core drilling will establish the boundaries of the enriched areas within the kimberlite and provide core for microdiamond sampling, resulting in an estimated grade. The zones of higher grades will then be tested by large diameter drill holes (LDDH) to confirm the microdiamond grade and then to establish revenue estimates. The LDDHs have a diameter of 914 mm and will provide material for the mini-bulk samples.

This approach had been used in other De Beers projects to ‘manage the risk’.

The high priority zones in 120, 147 and 121/221 are being tested by eight core holes followed LDDH drilling. Eight new geophysical targets will also be tested by core drilling with 24 holes. Five LDDHs have been completed into 140 and another four holes are scheduled to be completed before Christmas into 122.

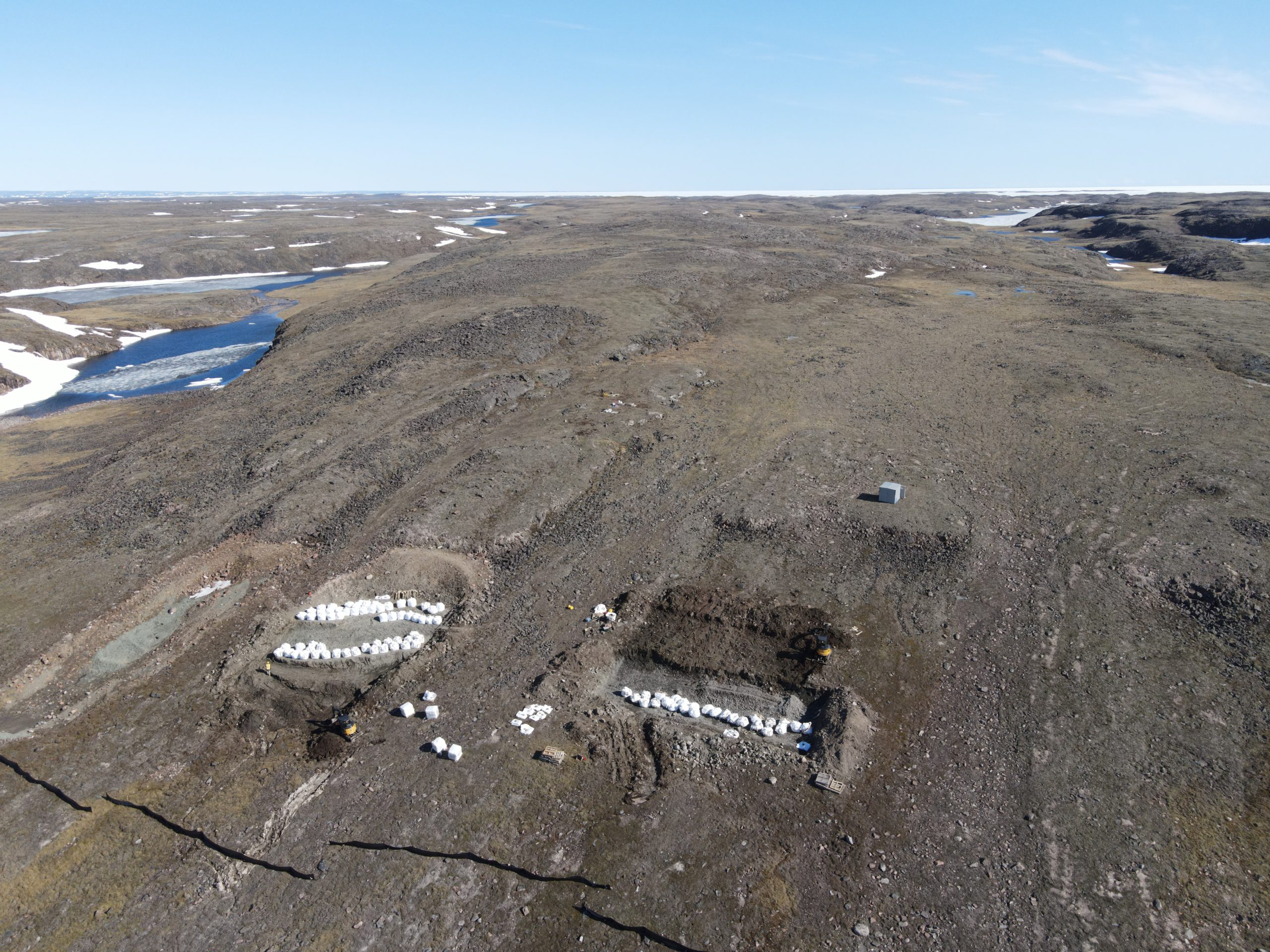

The program will be run out of the joint venture’s full service camp, which accommodates up to 56 people including 11 geoscientists and 27 drill personnel. The camp is about 55 km east of Prince Albert on the joint venture property, in the Fort la Corne Provincial Forest.

The joint venture is at a crossroads now. The partners have decided that they would like to have a pre-feasibility decision within three years. This fits in with De Beers’ window of opportunity for the diamond market. According to Richard Molyneux, president and CEO of De Beers Canada, the demand for diamonds is outstripping supply and the Fort la Corne project will help meet this demand. They see Canada as a source of high quality diamonds in a secure part of the world. The De Beers 2004 global exploration budget is US$92 million of which 43% will be spent in Canada.

To speed up the evaluation process the joint venture has decided to focus on the richer areas within a number of closely-spaced kimberlites as potential mining material.

The average grade of any individual kimberlite is low. By selectively mining the higher grade areas, it is possible that sufficient high grade mill feed can be defined in order to justify advancing the project to the next major phase.

Details of how to do this are being formulated in monthly meetings between the partners. The goal is to do the geo-technical and environmental work at the same time as exploration results are being compiled for a pre-feasibility study.

The exploration approach in the past has been almost too successful in finding kimberlites. Now the partners have to be innovative on their way to reaching a go/ no-go production decision.

In his remarks to media people and local politicians gathered at the exploration camp in late September, Kensington’s president and CEO, Robert McCallum, stated that Saskatchewan is the world’s largest producer of potash and uranium; he would like to see diamonds added to that list. With such a large field to explore the potential is there.

Comments