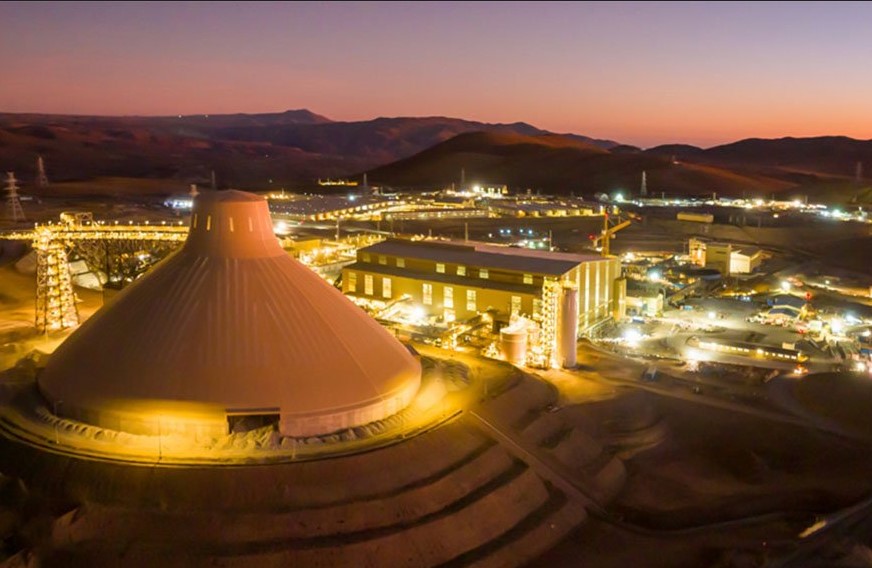

ONTARIO – Toronto-based Lexam VG Gold has the results of a preliminary economic assessment based on developing open pits to recover gold from four former producers – Buffalo Ankerite, Davidson Tisdale, Fuller and Paymaster – in Timmins. The study way completed by RPA Inc. based on the June 2013 resource estimate.

Such a project would have an after-tax net present value of C$33 million (7.5% discount) and internal rate of return of 32%, and a 2.1-year payback, based on US$1,300/oz gold. Average production would be 45,000 oz over each of the 6.5 years of mine life. Preproduction capital totalling $58 million will be needed, and cash costs over the life of the project would be US$865/oz. The PEA assumes that the ore will be toll milled and contractors will be hired for a portion of the waste stripping.

Lexam said that the potential exists to increase the resource base, both at surface and to depth. Future exploration will focus on both.

Readers might enjoy the photo album at LexamVGgold.com, especially the visible gold.

Comments