The top business risks for Quebec mining companies

A rebound in commodity prices and a lower Canadian dollar have injected fresh momentum into the mining industry in Quebec.

In some ways, this is a continuation of the strengthening we’ve seen across the industry since the financial crisis. Things have improved significantly since 2008, with producers across the province shoring up their balance sheets and holding much healthier cash balances. And on the cost side, miners are continuing to drive down expenses through a focus on productivity and the subsequent automation and digitization of their operations.

Even with these positive indicators, insufficient financing and volatility in the mining industry continue to persist, and a number of other significant business risks pose challenges for Quebec producers. Based on EY’s 2017 ranking of the business risks facing mining and metals, the following three risks stand out as particularly relevant for producers and explorers based in the province.

Productivity

While mining companies continue to focus on productivity gains, the risk of falling behind remains real. As a result, productivity is the top risk for CEOs and their companies’ boards. By adopting a manufacturing mindset, miners can manage variability and hence improve productivity. In doing so, digital alignment, a market-to-mine approach and a zeroloss focus culture will significantly close the integration gap.

Digital technology will remain critically important to driving further productivity improvements for mining companies.

For example, using technology to create a complete digital picture of an orebody can help with plant optimization through real-time recovery management, allowing producers to accurately forecast feed types.

Advanced modelling can also help producers understand bottlenecks in their value chains, which can be difficult to study as they are spread over long distances.

Finally, using predictive analytics to extend maintenance windows and automated planning and scheduling will help further drive down costs and optimize asset productivity.

All of these have the potential to drive cost savings in operating productivity, and even have a positive impact across areas like back-office process and risk management.

Cash optimization

Strengthening commodity prices and cost-cutting measures have led to stronger cash generation and improved balance sheets. However, the industry’s transition back into growth mode will create new cash demands.

Working capital investment is set to rise due to increased activity. In addition, the curtailment of sustaining capital expenditures, which helped miners optimize cash, is unlikely to continue aggressively as in recent years. Optimizing these competing capital demands will be critical as commodity prices continue to be volatile.

Resource replacement

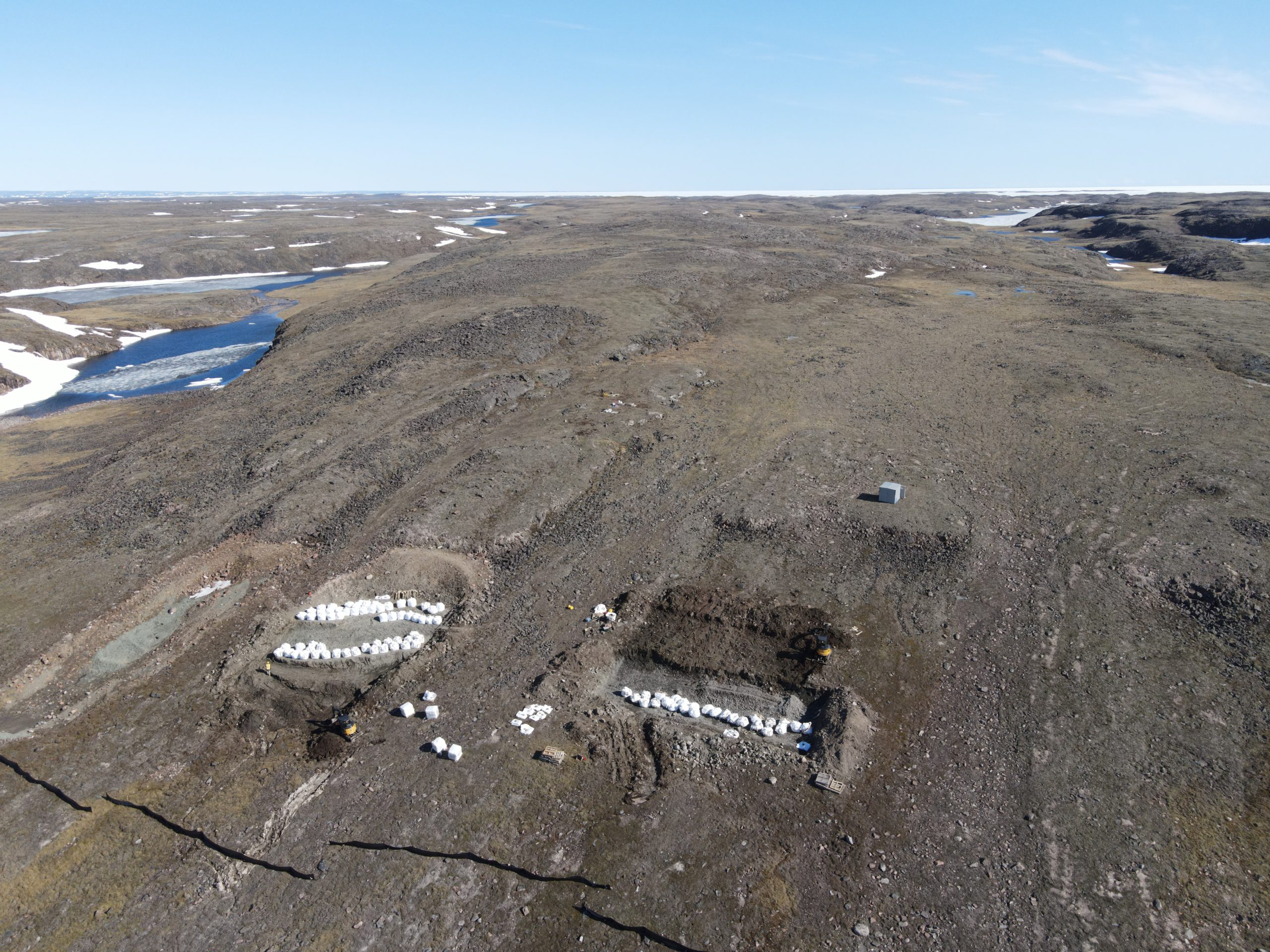

After peaking in 2012, exploration budgets have fallen dramatically around the world and haven’t rebounded. To put this in context, investment in exploration was down 66% to US$6.8 billion in 2016, from US$20.5 billion four years earlier, according to a March 2017 report by S&P Global Market Intelligence. The picture in Quebec has been no different, with lower investments in future projects. Recent data does show that global drilling has increased as the sector returns to growth. However, challenges remain as exploration has become more expensive as reserves are harder to access, more remote or on environmentally sensitive land.

To overcome these challenges, in addition to bolstering exploration spending, miners are forming strategic partnerships with junior miners to expand their reserve base, acquiring existing projects or mines, as well as improving technology to achieve higher exploration success rates.

The degree to which these business risks impact any given producer will vary, but Quebec-based mining and metals companies have to pay attention to them in the years ahead, and develop proactive strategies for mitigating challenges long before they are knocking on the front door.

ZAHID FAZAL is partner, Assurance Services, and the Quebec Mining and Metals Leader at EY Canada

Comments