Barrick’s Nevada mines pay out for gold miner

Ambition, combined with vision and drive, is part of what has brought Barrick Gold this far and it’s because of high-quality mines like Cortez, Goldstrike and Turquoise Ridge, that the company is in a position to increase profits by reducing production costs and improving productivity.

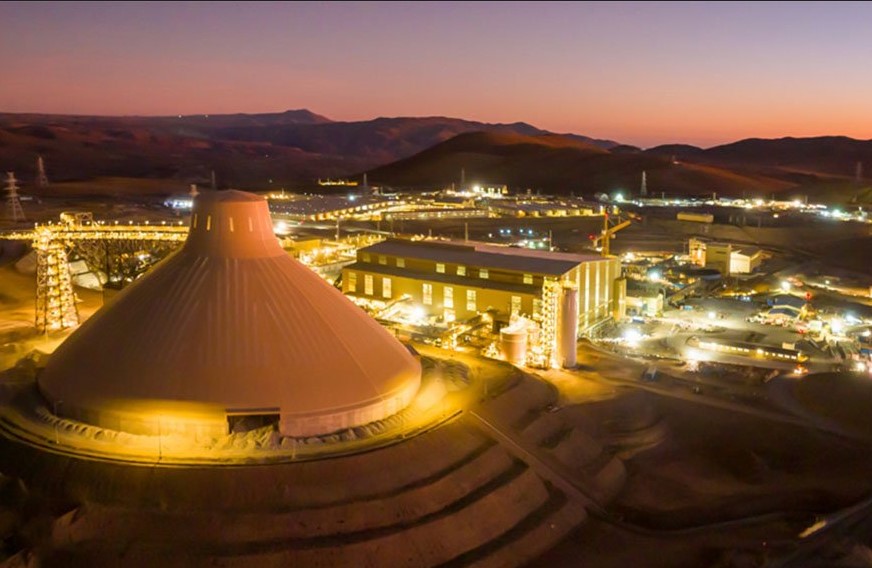

Cortez mine.

Elko, Eureka and most of all, Winnemucca are the names of three places that most people have never heard of, and moreover, have no idea where they’re located.

Adding the names Cortez, Goldstrike and Turquoise Ridge probably doesn’t help much either when it comes to pinpointing these locations.

But the words “in the desert” and “good fortune” are two clues that should help the inquisitive lead to Nevada where the three mines are located.

It’s also where Barrick Gold of Toronto is now working to make those three mines some of the more productive and profitable gold mines in the entire industry.

As most people know, there are few Canadian mining companies that have experienced more success than Barrick Gold of Toronto when it comes to developing gold mines.

In fact, since it was founded in 1983 by entrepreneur and philanthropist Peter Munk, the company has discovered, developed or operated more than 30 gold properties around the world, and thanks to its unrelenting drive to become an industry leader, it has earned the title as The World’s Number One Gold Miner.

For more than 33 years now, Barrick Gold has worked in countries including Canada, Argentina, Australia, Chile, Dominican Republic, Papua New Guinea, Peru, Saudi Arabia, Tanzania, Zambia, and the United States, now home to three of its most important assets: the Cortez, Goldstrike and Turquoise Ridge mines.

Goldstrike and Cortez, along with its Lagunas Norte mine in Peru, the Veladero mine in Argentina and the joint venture Pueblo Viejo mine in Dominican Republic (Barrick owns 60 per cent), are expected to account for about 70 per cent of the company’s gold production in 2016 at all-in sustaining costs of $650-$700 per ounce. Barrick’s portion of Turquoise Ridge accounts for another five per cent of production at all-in sustaining costs of $640-$700 per ounce.

The company is targeting gold production of up to 5.5 million ounces in 2016, at all-in sustaining costs somewhere in the range of $750-$790 per ounce, the lowest among all senior producers. Barrick says it plans to maintain production levels between 4.5-5.5 million ounces of gold through 2018. The company has also set an aggressive target to reduce all-in sustaining costs to below $700 per ounce by 2019.

While the company’s production levels have declined in recent years, that has been intentional. Since early 2015, Barrick has undertaken a sweeping overhaul of its portfolio, selling non-core mines and paying down more than $4 billion in debt.

The company has pruned its portfolio back to focus on a smaller number of core mines in the Americas region.

Barrick has also re-organized itself around a decentralized model that puts more accountability and authority at the mine level, empowering local mine managers to think of themselves as the CEO of their own business.

The company is no longer concerned on growing its production volume. Instead, Barrick says it will focus exclusively on growing free cash flow per share. While the company is producing fewer ounces than it has in recent years, it is generating significantly more free cash flow per share.

At the end of 2015, Barrick Gold had gold reserves of 91.9 million ounces and measured and indicated gold resources of 79.1 million ounces, the largest reserves and resources in the gold industry. At 1.88 grams per tonne, the company’s five core mines have an average reserve grade that is more than double that of its peer-group average.

All of this sounds ambitious, but “ambition,” combined with “vision” and “drive,” is part of what has brought Barrick Gold this far and it’s because of high-quality mines like Cortez, Goldstrike and Turquoise Ridge, that the company is in a position to increase profits by reducing production costs and improving productivity.

In fact, the company’s Nevada operations have long served as the cornerstone of Barrick’s success, and the company is betting big on its future in the state.

Cortez Mine

West wall of Cortez pit.

Take the company`s Cortez mine for example. Not only is it neck and neck with Goldstrike as Barrick`s largest gold-producing mine in Nevada, trailing it by 25,000 ounces, it`s also one of the oldest mining camps in the State, dating back to the 1860s when silver was discovered in the area. Located about 120km southwest of Elko, gold mining activity in the Cortez district took place on and off from the 1930s through the 1980s as various deposits were mined. But it was the discovery of the Pipeline deposit in the 1990s that kicked off the modern gold mining era at Cortez. Barrick acquired the property when it purchased Placer Dome in 2006, developing a new open pit and underground mine on the site known as Cortez Hills, located approximately 16 kilometers from the existing Pipeline pit and mill.

Truck maintenance at Cortez.

Cortez has more than 11 million ounces of gold in proven and probable reserves, and another 2.2 million ounces in measured and indicated resources. And Barrick hasn’t found the end of the Cortez Hills deposit yet. The mine is expected to produce around one million ounces of gold in 2016 at all-in sustaining costs of $520- $550 per ounce, putting it in an elite class of global gold mines.

Operations at Cortez are split between two complexes, Pipeline and Cortez Hills.

The Pipeline complex is mined via open pit. Cortez Hills is mined via open pit and underground. Both complexes have heap leach facilities. Higher grade oxide ore is processed in an onsite conventional SAG mill with CIL recovery with a design capacity of 14ktpd. Refractory ore is trucked 125km to Goldstrike for processing in the roaster or autoclave-TCM circuit.

In 2015, Cortez mined 413,000 tonnes per day from open pit sources and 2,500 tonnes per day from the underground. The Cortez open pit is a conventional truck and shovel operation with a typical bench height of between six and 15 meters. The primary open pit loading fleet consists of four P&H electric shovels and one Hitachi EX5500. Hauling in the open pit is handled by 20 Liebherr T282s and 28 Caterpillar 795Fs.

Underground mining at Cortez Hills consists of underhand cut and fill with cemented rock fill as backfill. The mine operates parallel twin declines, five meters wide by 5.5 meters high with crosscuts every 150 meters.

Even after a long history of mining in the district, Barrick has big plans for Cortez.

The company is currently working on two projects to expand gold mining in the district. The first is a major expansion of the Cortez Underground mine, known as the Deep South Project.

The project would contribute average underground production of more than 300,000 ounces per year between 2022 and 2026 at average all-in sustaining costs of approximately $580 per ounce. Initial capital costs are estimated to be $153 million. This expansion will enable the company to access an additional 1.7 million ounces of proven and probable gold reserves in the Deep South zone.

As part of the Deep South expansion, Barrick plans to use long hole stoping to mine the ore body rather than the cut and fill method, which will nearly double the mining rate to 4,500 tonnes per day, up from 2,500 tonnes per day. Based on current plans, production from the Deep South is expected to begin around 2022- 2023, ramping up to full production rates in 2024.

Cortez is in the rare and enviable position of developing multiple orebodies, not just Deep South but also Barrick’s massive Goldrush greenfield discovery, located six kilometers from the Cortez Hills mine. At the end of 2015, the Goldrush deposit had an additional 8.6 million ounces of measured and indicated resources at an average grade of 10.6 grams per tonne.

Barrick is now advancing a plan to build a new underground mine at Goldrush. The prefeasibility study contemplates an estimated initial capital investment of approximately $1 billion.

Based on current plans, average annual production for the first full five years of operation is expected to be 440,000 ounces of gold at all-in sustaining costs of $665 per ounce. Refractory ore would be transported to Goldstrike for processing. The prefeasibility study contemplates a mine life of 21 years, with first production as early as 2021, and sustained production in 2023.

And if that wasn’t enough, Barrick can’t seem to stop finding gold in the Cortez District. The company has a new target known as Fourmile, located one to three kilometers north of the Goldrush discovery. The area is geologically similar to the high grade Deep-Post and Deep-Star deposits in the Goldstrike area and early drilling has intersected mineralization well above the average grade of the measured and indicated resources at Goldrush.

Goldstrike Mine

Headframe of the Goldstrike mine.

Barrick’s Goldstrike Mine is located in North-Eastern Nevada, 60 kilometers northwest of Elko on the Carlin Trend, a legendary gold region known for its world class deposits.

In fact, Goldstrike not only qualifies for world-class status, it leads all others by holding the titles of “The Largest Gold Mine in North America,” and “The Largest Carlin-type Mine in the World.” (Carlin is a type of deposit where gold was epithermally deposited in carbonate or sedimentary rocks by magnetic heat) When Barrick purchased the Goldstrike property for $62 million at the end of 1986, the company was famously criticized for overpaying for a piece of land many thought was worthless.

Since then, Goldstrike has produced over 41 million ounces of gold, becoming one of the richest gold deposits in the world and fueling three decades of growth at Barrick. Today the mine has 8.5 million ounces of proven and probable gold reserves at an average grade of 3.59g/tonne and measured and indicated resources of 1.8Moz at average grade of 6.02g/tonne.

The operation consists of the

Two pits and two underground mines support the Goldstrike project.

. Meikle is a high-grade ore body which is mined by transverse longhole stoping, and underhand drift and fill mining methods. Rodeo is a trackless operation, using two different underground mining methods: long-hole open stoping and drift-and-fill.

In 2015, Goldstrike mined 194,000 tonnes per day from open pit sources and 4,800 tonnes per day from the underground. Like Cortez, Goldstrike’s open pit is a conventional truck and shovel operation with a typical bench height of between six and 13 meters. While a portion of the pit has been backfilled, its original dimensions are astounding at 3.3km long by 2km wide by 600m deep. The primary open pit loading fleet consists of four P&H electric shovels and one Hitachi EX5500. Hauling in the open pit is handled by 30 Komatsu 930Es.

In addition to hosting one of the largest gold orebodies in the world, Goldstrike has evolved into a cutting-edge gold processing hub that treats ore from the nearby Cortez mine and other sources. Goldstrike has facilities for heap leaching and conventional cyanide leaching. It is also home to a 16,000-tonne-per day roaster facility and autoclaves for processing refractory ores.

More recently, the company has introduced a fifth processing option, known as Total Carbonaceous Matter (TCM).

Goldstrike is the only place in the world that is using a cyanide free leaching process on a commercial scale. Developed in house by Barrick’s technology team, TCM uses a chemical known as “thiosfulate” in place of cyanide to treat double refractory ores that have gone through the autoclave circuit.

Annual production at Goldstrike peaked at an eye-popping 2.5 million ounces of gold in 2000. While the mine is producing closer to one million ounces a year now, it still ranks among the largest gold mines in the world.

Turquoise Ridge Mine

Dan Twitchel of the Turquoise Ridge environmental team.

The Turquoise Ridge mine is located in the Potosi Mining District which is about 70km North-East of Winnemucca, Nevada. Originally known as the Getchell mine and named after Nevada Senator Nobel Getchell, gold mining in the area goes back to 1934. Historic ruins of a town site constructed for those working the grounds date back to 1937 and make for a tourist attraction.

Turquoise Ridge is now a joint venture between Barrick, which owns 75 per cent and operates the mine, and Newmont, which owns the remainder. The Turquoise Ridge mine is an underground operation that began production in 1998. At the end of 2015, it contained 5.25 million ounces in reserves (100 per cent basis) at an average grade of 15.3 grams per tonne – the highest reserve grade in the company’s operating portfolio and among the highest in the entire gold industry.

The mine also has 14.25 million ounces of measured and indicated resources (100 per cent basis). The deposit remains open to the northeast, with significant potential to add additional reserves and resources through drilling.

Amanda Andrews in the Turquoise Ridge lab.

In 2015, Turquoise Ridge produced 271,250 ounces of gold (100 per cent basis) setting a new benchmark for annual production at the property. The mine is projected to exceed this benchmark in 2016, marking a near doubling of the site’s production over the last six years.

Accessed by two shafts, mining uses the cut-and-fill methods. Due to the irregular nature of the area’s geology the cut and fill method can require a combination of undercuts and top cuts in order to efficiently extract ore and minimize dilution. Barrick maintains a surface quarry and crusher on site to provide aggregate for cemented backfill.

Like Cortez, Barrick has plans to expand production at Turquoise Ridge. The mine is now in the midst of a three-phase expansion project. The first phase involves making productivity improvements to sustain a mining rate of 1,825 tonnes per day. The second phase involves sinking a new ventilation shaft, which could be converted to a production shaft in the third phase of the project. This could double annual production to about 500,000 ounces of gold per year (100 per cent basis). The project requires initial capital expenditures of approximately $300-$325 million (100 per cent basis) for additional underground development and shaft construction.

Because the host rock at Turquoise Ridge is very soft, Barrick has developed a soft ground mining expertise which has helped the mine achieve the best safety record in the entire company, recently surpassing three years without a Lost Time Accident. This is made all the more notable when you take into account that the operation was nicknamed “the widow maker” when operations first began due to the amount of fatalities that occurred in those early days.

Today, Turquoise Ridge’s nickname should be “The Money Maker.”

Comments